Monese and Wise (formerly known as TransferWise) are both mobile banks that offer services such as current accounts, money transfers, and debit cards.

One of the main differences between the two is their target audience. Monese is designed for people who have difficulty opening traditional bank accounts, such as non-residents or people with poor credit histories, while Wise targets a more global audience of people who need to transfer money internationally.

In terms of fees, both Monese and Wise have low or no fees for many services. Monese offers free card transactions and low fees for international money transfers, while Wise has low fees for international money transfers and currency exchange. However, Monese charges a monthly fee for some of its premium accounts, while Wise does not.

Another difference is the way the two mobile banks handle currency exchange. Monese offers instant currency exchange at the interbank rate, while Wise uses a peer-to-peer model that can result in lower fees but slower transfer times.

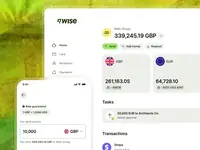

Finally, the two banks have different user interfaces and features. Monese's app is designed to be simple and user-friendly, while Wise's app is more advanced and offers additional services such as business accounts and investment options.

Overall, Monese and Wise offer similar services but with different target audiences and approaches. Monese is a good option for people who struggle to open traditional bank accounts, while Wise is ideal for those who need to transfer money internationally.