Novo and Wise Business are two mobile banking options that cater to the needs of modern businesses, each with its own unique set of features and benefits. Novo is designed specifically for small businesses and startups, offering a no-fee banking experience that is both straightforward and efficient. It integrates seamlessly with a range of popular business tools such as QuickBooks, Stripe, and Shopify, which simplifies financial management for entrepreneurs. The Novo app is user-friendly, providing functionalities like instant transaction notifications, easy money transfers, and mobile check deposits. With free ACH transfers, mailed checks, and access to a wide network of ATMs, Novo ensures that managing business finances is convenient and hassle-free.

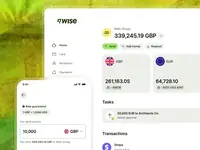

Wise Business, formerly known as TransferWise, is renowned for its ability to handle international transactions with ease. It offers a powerful solution for businesses that operate globally or deal with foreign clients and suppliers. Wise Business stands out with its low-cost international money transfers, allowing users to send and receive money in multiple currencies at real exchange rates with minimal fees. The platform supports holding and managing balances in various currencies, making it ideal for businesses with a global reach. Additionally, Wise Business provides local bank details for multiple regions, enabling businesses to receive payments as if they had a local bank account in those countries.

While both Novo and Wise Business provide valuable banking services, they cater to different business needs. Novo is ideal for small businesses and startups looking for a cost-effective, integrated banking solution within the domestic market. Its strong integration with business tools and no-fee structure make it perfect for managing everyday business finances without worrying about hidden costs. On the other hand, Wise Business is better suited for companies engaged in international operations. Its ability to offer low-cost, real-exchange-rate international transfers and support for multiple currencies makes it an indispensable tool for businesses with a global presence.

In summary, the choice between Novo and Wise Business depends on the specific needs of the business. Novo excels in providing a cost-efficient and integrated banking experience for domestic operations, while Wise Business shines in facilitating low-cost, efficient international transactions and managing multi-currency accounts. Both platforms offer distinct advantages, making them valuable tools for different aspects of business finance.