Currensea and Wise (formerly TransferWise) are both fintech platforms that have established their niches in the international transactions and currency exchange sector.

Currensea is a UK-based fintech that provides a travel debit card that connects directly to users' existing bank accounts, negating the need for an additional account or card for foreign transactions. This approach significantly reduces foreign transaction fees, making it a preferred choice for frequent travellers or those making regular international payments. However, Currensea primarily focuses on international transactions, and it doesn't offer a broader range of general banking services.

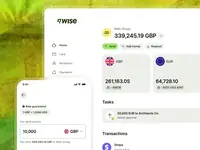

On the other hand, Wise is known for its affordable and transparent money transfers, which makes it popular among expats, freelancers, and businesses working with international clients. Besides international transfers, Wise also offers a multi-currency account, which allows users to hold, receive, and send money in multiple currencies. This account comes with a debit card for global spending. However, it's important to note that while Wise provides one of the most cost-effective solutions for international transactions and currency exchange, it doesn't offer a full suite of traditional banking services like some of its competitors do.

In summary, Currensea and Wise both provide specialised solutions for international transactions. Currensea delivers a simplified, cost-effective solution for users looking to streamline their international transactions, while Wise offers a comprehensive platform for managing multiple currencies and making international transfers. The choice between these two platforms will largely depend on the specific banking needs and priorities of the user.