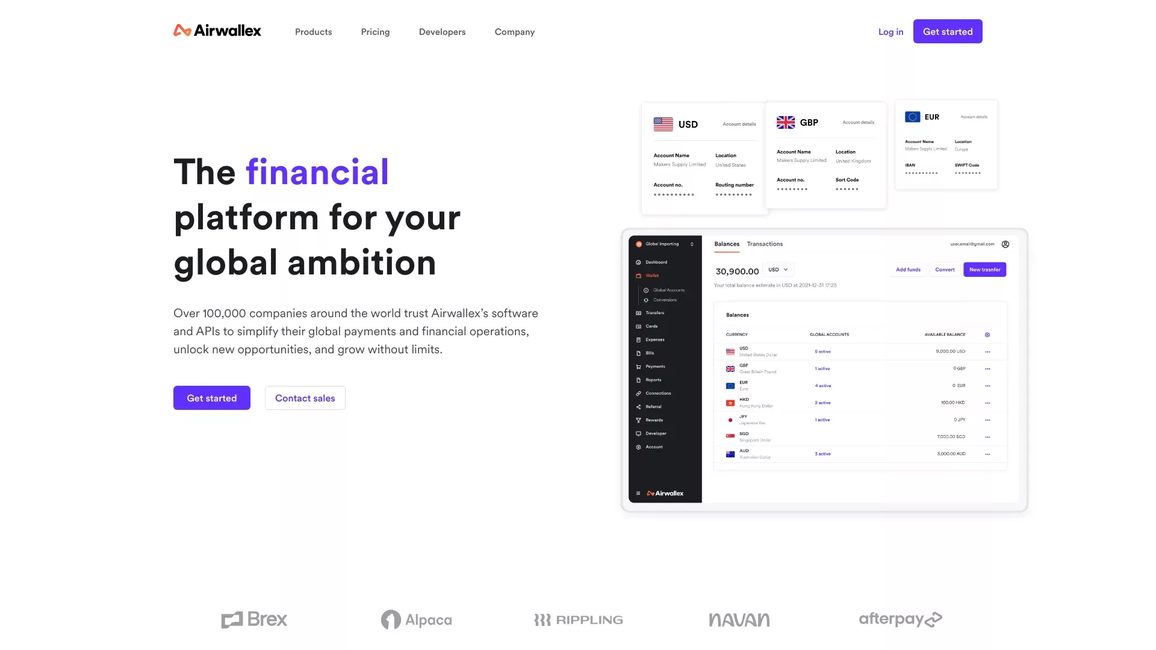

Airwallex is a global financial technology company that provides a comprehensive banking solution for businesses, enabling them to manage cross-border payments, expenses, and financial operations seamlessly. Founded in 2015, Airwallex aims to simplify the complexities of international finance through its innovative platform, which integrates various financial services into one cohesive ecosystem. This platform offers businesses a range of tools to handle international transactions with ease, ensuring cost-effectiveness, speed, and transparency.

One of Airwallex's core offerings is its cross-border payments service, which allows businesses to send and receive money in multiple currencies without the hefty fees and unfavorable exchange rates typically associated with traditional banks. By leveraging its extensive network of global banking partners and using local clearing systems, Airwallex ensures that transactions are processed quickly and at competitive rates. This capability is particularly beneficial for businesses operating in multiple countries or engaging in international trade, as it significantly reduces the financial friction involved in cross-border transactions.

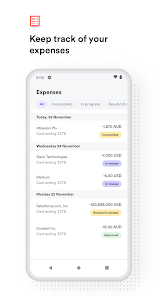

In addition to payments, Airwallex provides businesses with virtual and physical multi-currency cards, which can be used for corporate expenses worldwide. These cards are integrated with Airwallex's expense management tools, enabling businesses to track and control spending in real-time. The platform also offers features like automated expense reporting and reconciliation, making it easier for companies to manage their financial operations and maintain compliance.

Furthermore, Airwallex's API suite allows businesses to integrate its financial services directly into their existing systems and workflows, providing a customizable solution that can scale with the business's growth. This level of integration ensures that businesses can maintain operational efficiency while expanding globally. Overall, Airwallex's innovative approach to business banking addresses the pain points of traditional banking systems, offering a modern, efficient, and scalable solution for today's global economy.

24/7 availability- anytime, anywhere

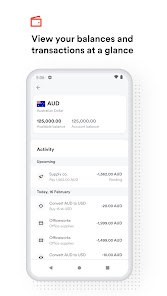

No matter where you are, at home or abroad, you can access your Airwallex account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

Get approved fast

Opening an account with Airwallex is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Airwallex doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

Lower fees

Another main reason to use Airwallex is the low (or no!) fees. Airwallex has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, Airwallex offers zero fees on all transactions, including purchases made overseas!

Makes traveling easier

Airwallex = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

Go paperless

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Airwallex everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.