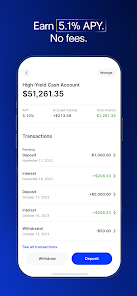

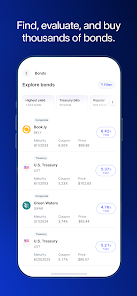

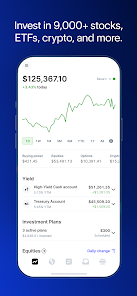

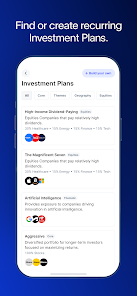

Public is an investing platform that caters to a new generation of investors by combining the best features of social networking with stock and ETF trading. It allows users to invest in publicly-traded companies with any amount of money, advocating for fractional share trading, also known as “slices”, which makes it accessible for individuals to invest with smaller amounts of money. Public fosters a community-focused experience, where users can follow other investors, exchange ideas, and share insights within a regulated environment to promote transparency and financial literacy.

The platform is designed to be intuitive and user-friendly, making it suitable for both beginners and experienced traders. With an emphasis on education, Public provides an array of resources to help users understand the market and make informed decisions. Public is particularly geared towards promoting long-term investing rather than day trading, emphasizing the value of building a diversified portfolio over time.

As a modern trading provider, Public operates with a commitment to not participating in Payment for Order Flow (PFOF), which is a common practice where brokers receive a fee from market makers for directing trades to them. Instead, Public has chosen alternative revenue streams, such as tipping, to align with their mission of transparency and trust. This has set them apart in an industry where PFOF is standard among many other trading platforms.

To ensure the security of its users' funds and data, Public implements robust security measures and is registered with the Securities and Exchange Commission (SEC), while being a member of the Financial Industry Regulatory Authority (FINRA). Moreover, accounts are SIPC insured, providing additional protection for investors' assets.