Tide and Wise (formerly TransferWise) are both key players in the world of mobile and online banking, but they cater to slightly different needs and audiences. While both are designed to streamline financial transactions and offer increased convenience compared to traditional banking, the core features and benefits they offer vary significantly.

Tide is a UK-based banking platform specifically designed for small and medium-sized enterprises (SMEs), freelancers, and entrepreneurs. It focuses on providing an array of business-centric services such as fast account setup, integrated invoicing, and robust expense management. Tide also offers multi-user access, allowing several team members to operate a single account, a feature highly beneficial for businesses. The bank supports various payment types like faster payments, BACS, and CHAPS and aims to be a comprehensive financial management tool for businesses.

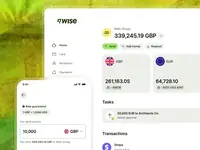

Wise, on the other hand, originally gained fame for its money transfer services, offering users the ability to send money abroad at lower costs by using real exchange rates without hidden fees. Over time, Wise expanded to offer a multi-currency account aimed at both individual consumers and businesses. This feature allows users to hold, send, and receive money in multiple currencies, which is particularly advantageous for freelancers, travelers, or businesses operating internationally. While Wise does offer business accounts, its suite of features doesn't go as deep into business financial management as Tide's.

Both services provide a mobile-first user experience and are regulated by financial authorities, ensuring customer funds are held securely. However, while Tide aims to offer an all-in-one business banking solution, Wise focuses on simplifying international money transfers and offering multi-currency accounts. Tide is more comprehensive for a business that primarily operates in one country but has varied business banking needs, whereas Wise is ideal for those who have more straightforward banking requirements but need to frequently transact in multiple currencies.

In summary, Tide and Wise serve different niches within the broader mobile banking ecosystem. Tide is geared towards SMEs and freelancers who require comprehensive business banking services. Wise, meanwhile, is ideal for individuals and businesses that need to manage money across multiple currencies. Your choice between the two would largely depend on your specific financial needs—be it complex business management or international money handling.