Monese is a dynamic and innovative financial technology company that provides a range of banking-like services through its mobile app. Founded in 2015 by Norris Koppel, Monese was established to address the difficulties faced by expatriates and migrants in opening bank accounts when they move to a new country. Although it offers many services typically associated with traditional banks, it is crucial to understand that Monese is not a bank; rather, it is an electronic money institution. This distinction means that while Monese provides digital financial services, it does not hold a banking license and thus operates under different regulatory frameworks than conventional banks.

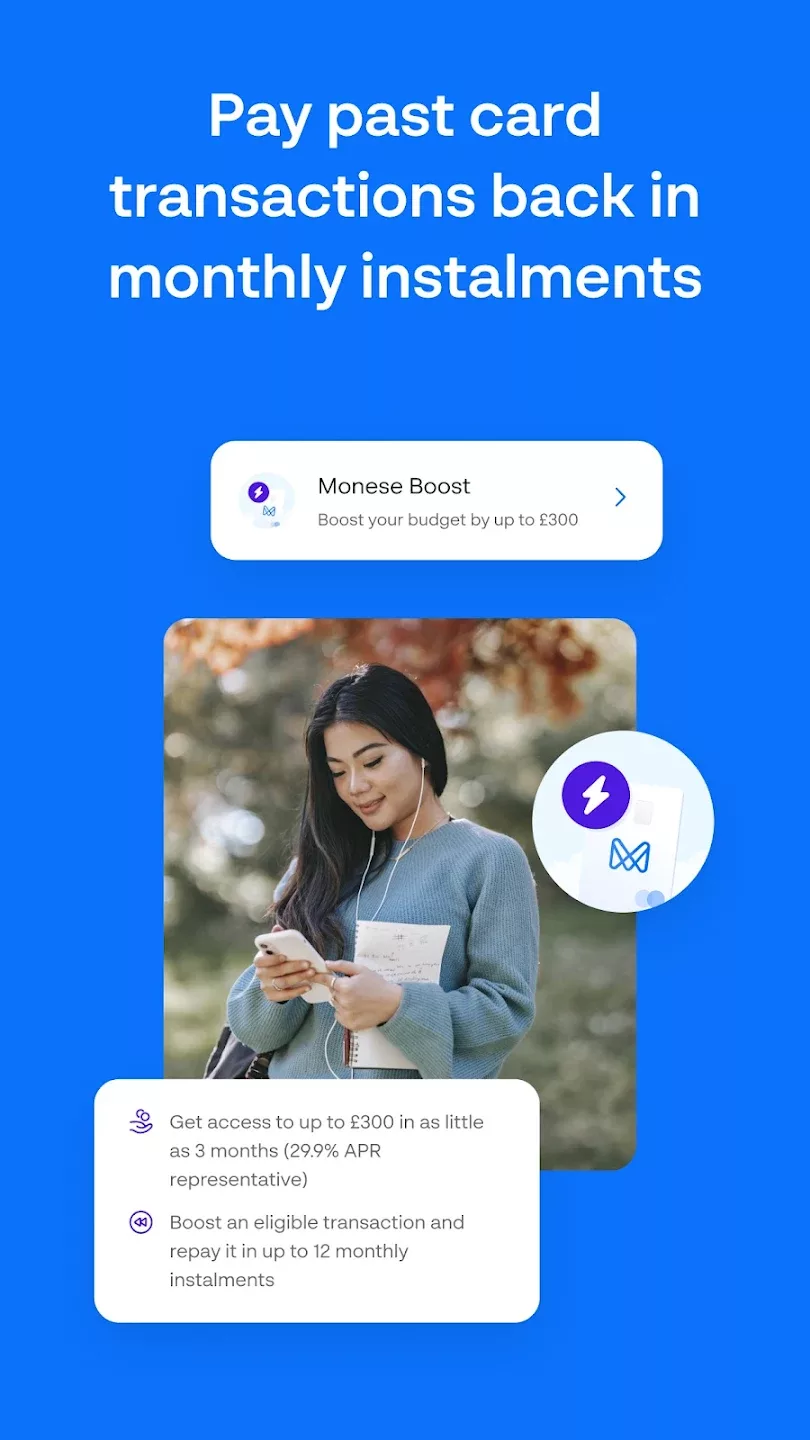

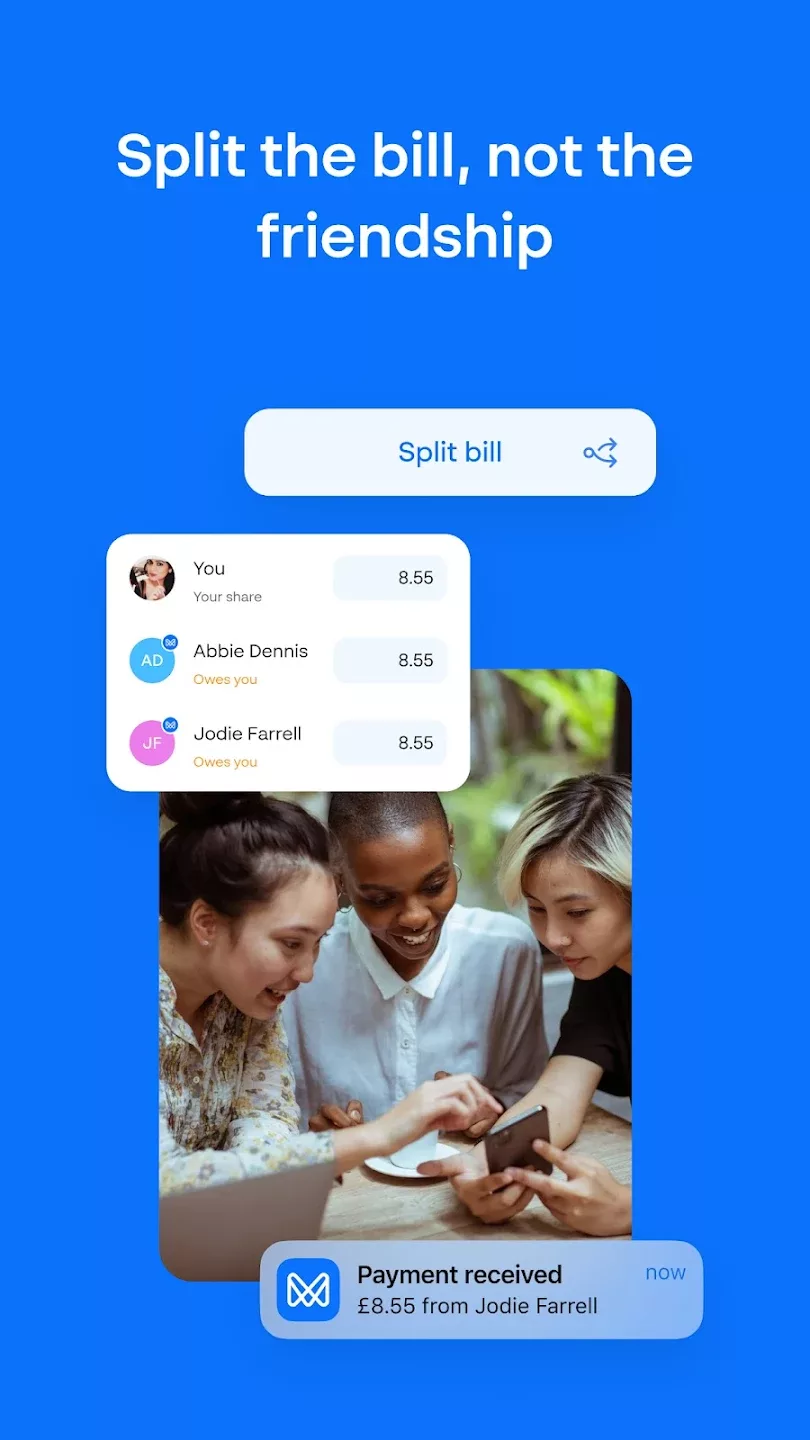

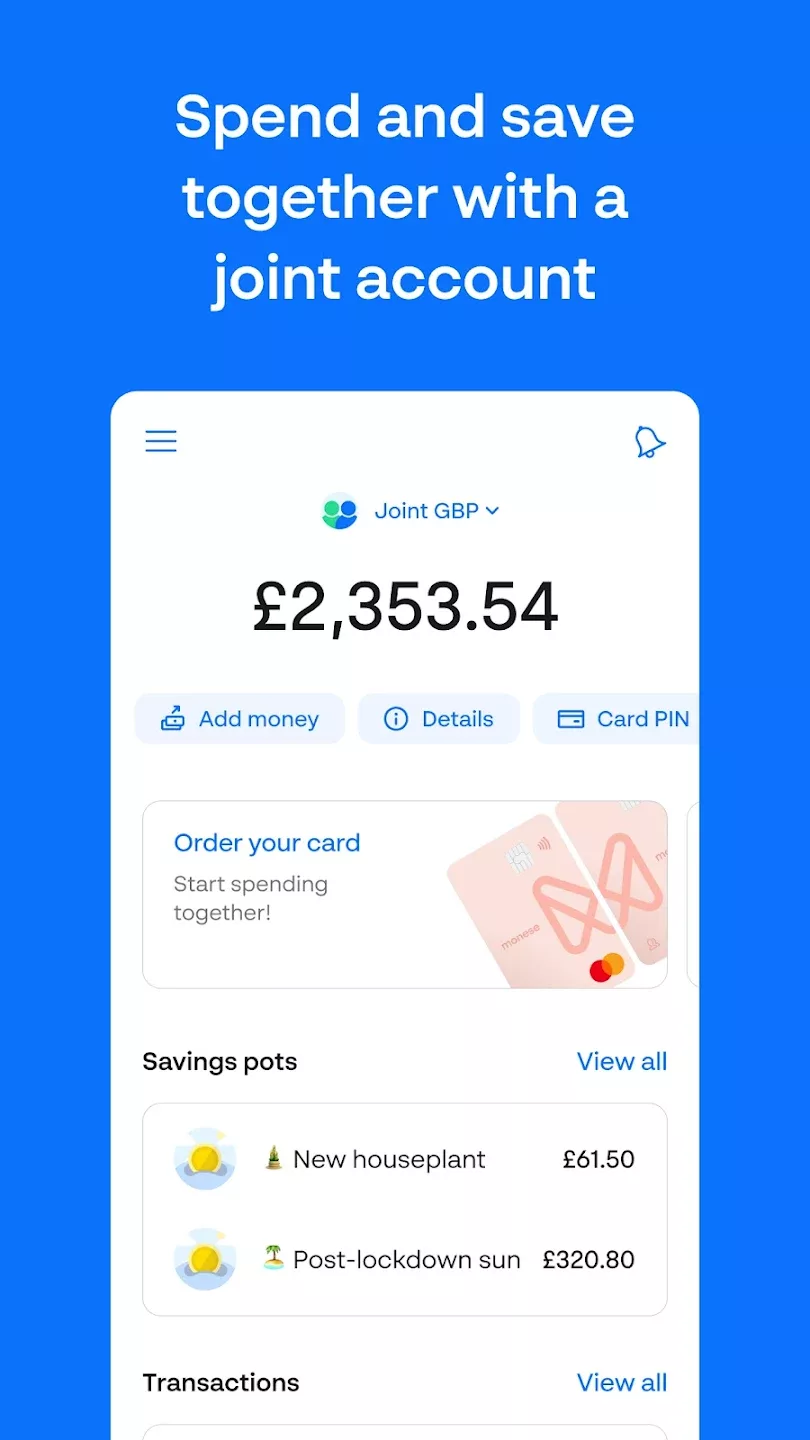

Monese's platform allows users to open a mobile money account quickly and easily, without the need for a local address or credit history, which are common barriers with traditional banks. Users can sign up and start using their accounts within minutes through the Monese app, available on both iOS and Android devices. The service supports multiple currencies, enabling customers to manage their finances across different countries seamlessly. Monese offers a variety of features, including direct debits, instant money transfers, and the ability to receive payments like a traditional bank account. Additionally, users can request a contactless debit card, which can be used for everyday transactions and ATM withdrawals globally.

Monese's fee structure is transparent, with several account plans to cater to different customer needs, ranging from free basic accounts to premium subscriptions with added benefits. These benefits can include higher allowances for free ATM withdrawals and foreign currency transactions, making it a versatile choice for both personal and business use. The platform is particularly popular among digital nomads, freelancers, and international students due to its flexibility and ease of access.

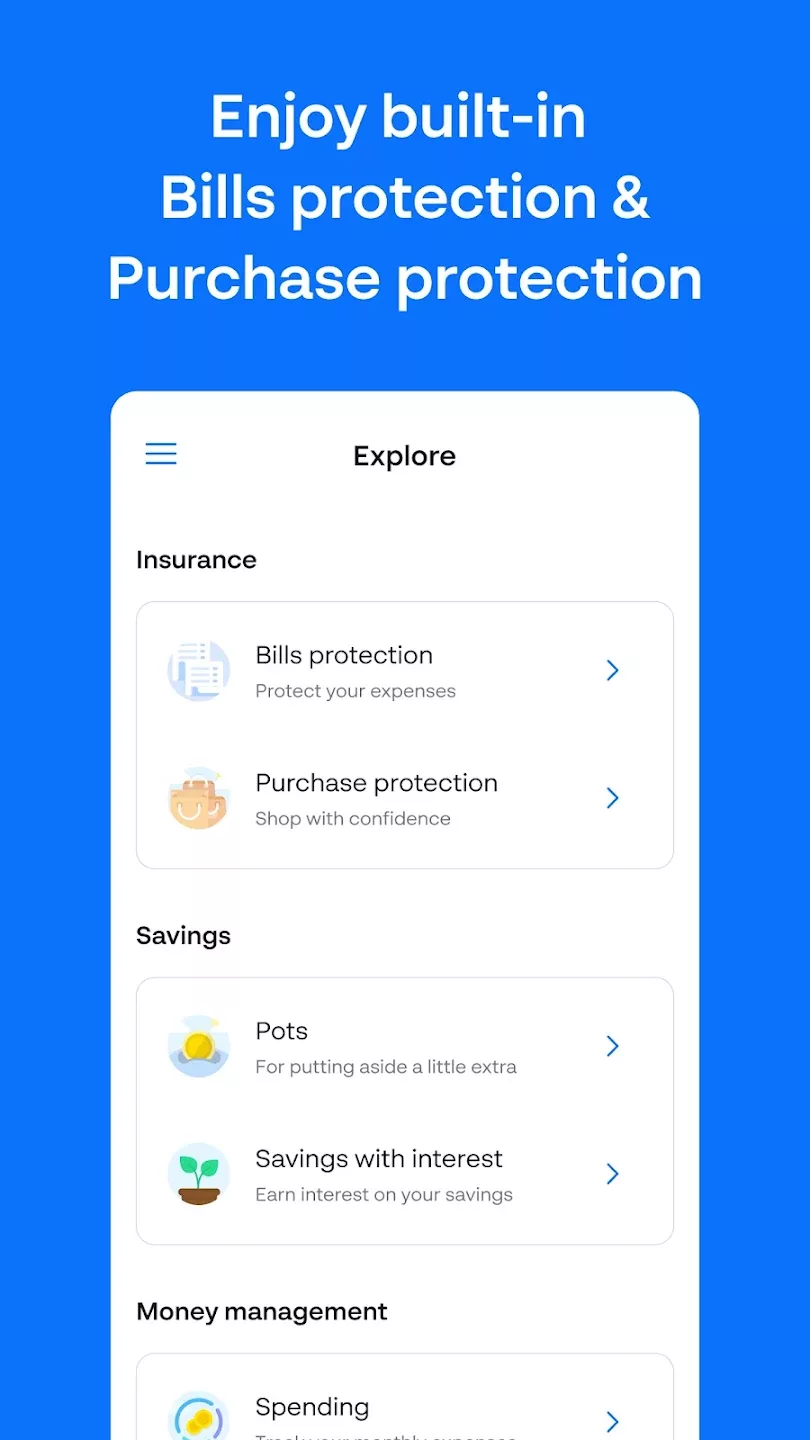

Security is a top priority for Monese. The company employs advanced security measures to protect user data and funds, including biometric authentication and real-time transaction monitoring. Since Monese is regulated as an electronic money institution, customer funds are safeguarded in segregated accounts, ensuring that they are protected and cannot be used for operational purposes by the company. This regulatory setup ensures that user funds are kept safe, although it differs from the deposit protection schemes typically associated with traditional banks.

Monese also emphasizes financial inclusivity, striving to offer services that cater to individuals who might be underserved by the traditional banking sector. Its approach is customer-centric, focusing on accessibility, simplicity, and efficiency. The company's commitment to innovation is reflected in its continuous development of new features and improvements to its app, aiming to provide a seamless and intuitive user experience.