Choosing the right financial solution is essential for businesses and freelancers aiming to streamline payments and expense management. Two strong players in the European market are Wallester Business and Tot. While both offer innovative financial tools, they serve different business needs.

In this comparison, we’ll explore the key features, strengths, and differences between Wallester Business and Tot, helping Italian businesses make an informed decision.

Company Overview

Wallester Business

- Founded: 2016

- Headquarters: Estonia

- Market Presence: EEA and UK, specializing in business payment solutions

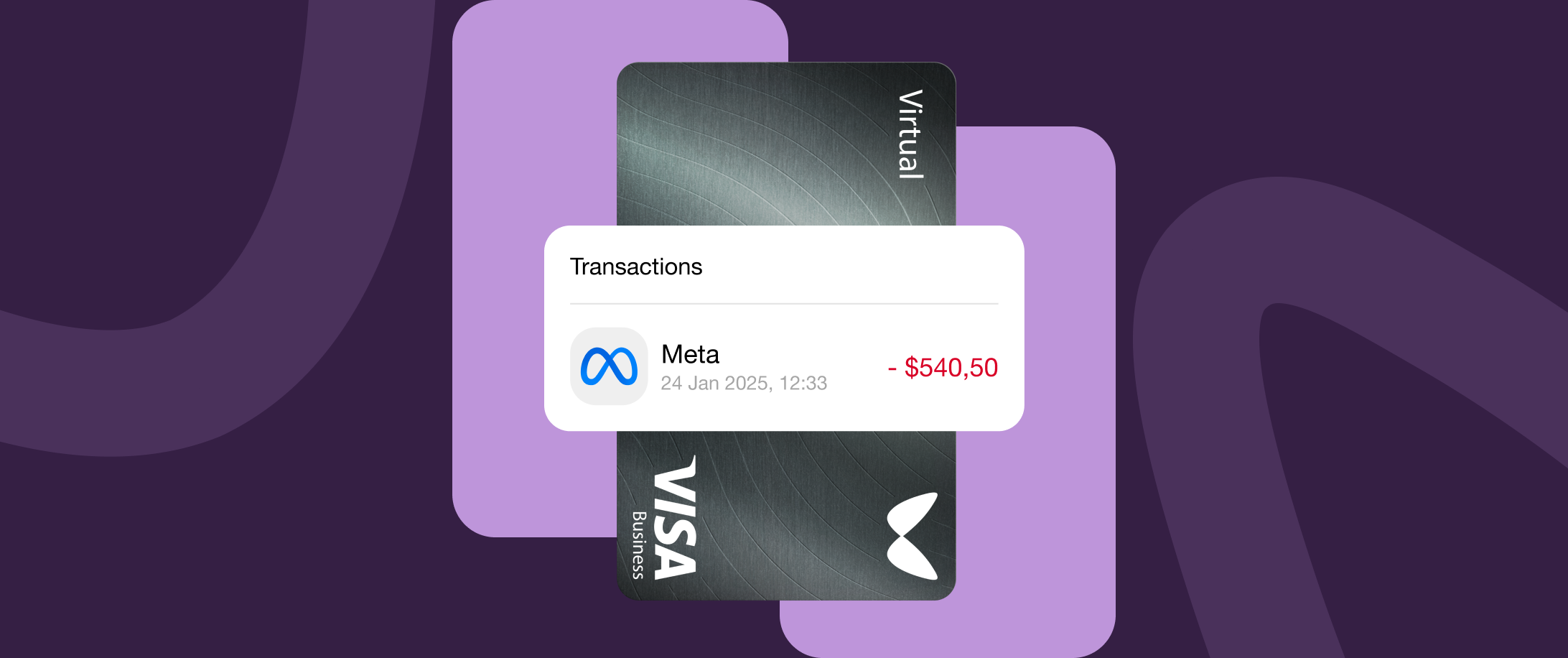

- Key Services: Virtual & physical corporate cards, real-time expense tracking, flexible payment solutions, API integrations

Wallester Business provides customizable virtual and physical cards designed for businesses of all sizes. With no sign-up fees and 300 free cards, it’s an attractive choice for companies needing scalable and cost-effective payment solutions. Go to Wallester.com

Tot

- Founded: 2022

- Headquarters: Italy

- Market Presence: Italy

- Key Services: Business accounts, corporate debit cards, invoicing, expense management

Tot is a financial platform aimed at small businesses and freelancers, offering a streamlined digital business account with invoicing tools and expense management solutions.

Features Comparison

| Feature | Wallester Business | Tot |

| Business Accounts & IBAN | No business accounts; payment infrastructure | Full business banking with IBANs |

| Virtual & Physical Cards | Unlimited virtual & physical cards | Limited corporate debit cards |

| Card Issuance & Limits | 300 free virtual cards | Tier-based limits on card issuance |

| Cashback & Rewards | No cashback, but cost-saving with free cards | No cashback or rewards |

| Pricing & Subscription Fees | Free to use, custom pricing for advanced features | Monthly subscription plans (starting at €7) |

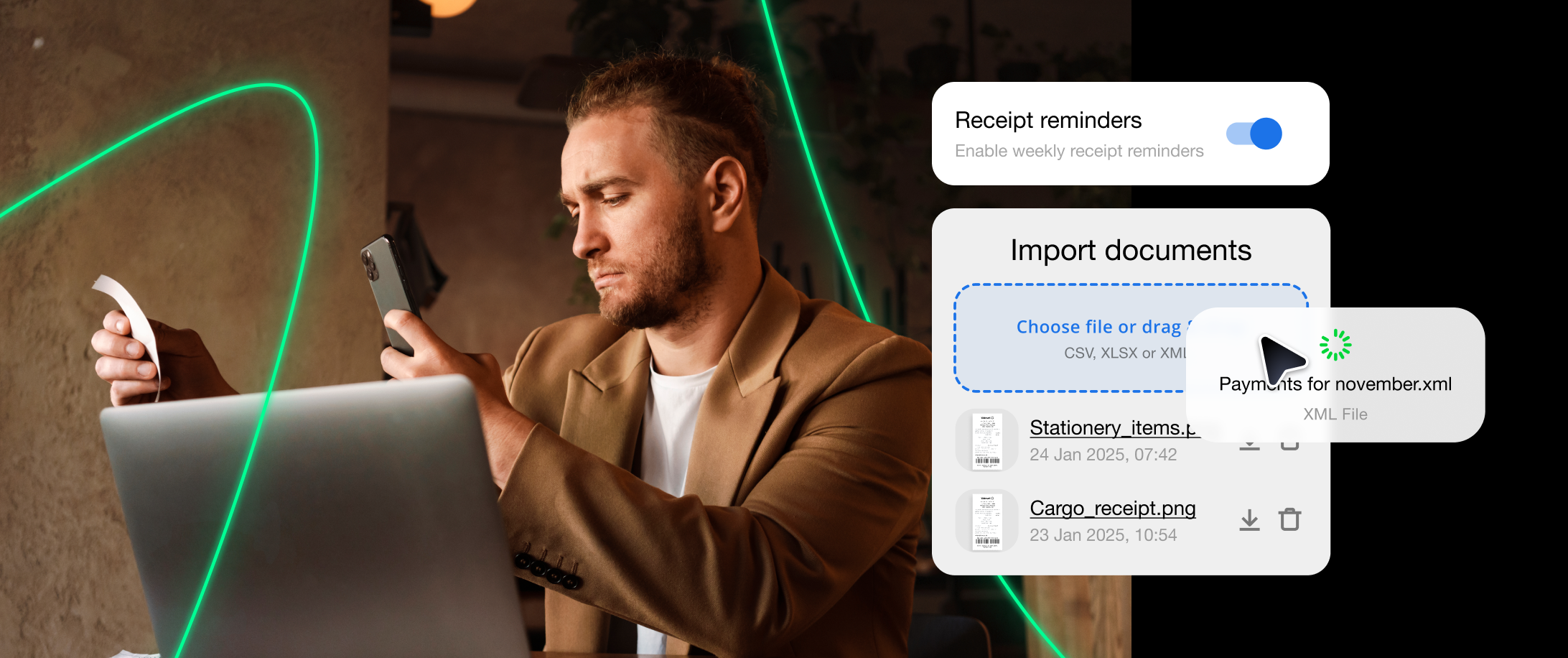

| Expense Management | Real-time tracking, advanced controls | Integrated expense categorisation |

| Accounting Integrations | API-driven integrations for custom needs | Basic accounting tool integrations |

| Customer Support | Dedicated business support | Multi-channel support (email, phone, chat) |

Pros & Cons

Wallester Business

Pros:

- Scalable virtual & physical card issuance with no upfront costs

- Flexible API integration for custom payment solutions

- Real-time transaction tracking & expense control

- Ideal for media buyers and digital agencies needing multiple payment cards

Cons:

- No traditional business banking or IBANs

- Not a replacement for a full business bank account

Tot

Pros:

- All-in-one digital banking with IBANs and invoicing

- Simple and user-friendly platform for small businesses

- Designed specifically for the Italian market

Cons:

- Limited card issuance compared to Wallester Business

- Monthly subscription fees required

- Lacks advanced payment infrastructure for larger businesses

Which One Is Best for You?

For businesses that require scalable, flexible virtual & physical card solutions, Wallester Business is the superior choice—especially for media buyers, digital agencies, and operations managers needing multiple corporate cards without high costs.

For freelancers and small businesses needing a full banking solution with IBANs and invoicing, Tot provides an intuitive financial platform designed specifically for the Italian market.

Conclusion

Both Wallester Business and Tot offer valuable financial tools but cater to different needs. If you focus on high-volume corporate card issuance with cost-effective scalability, Wallester Business is the best choice. Tot is a solid option if you need a simple, all-in-one banking platform tailored for freelancers and small businesses.

Explore Wallester Business’s features today and see how it can optimize your business payments!