Lightyear, the challenger investment app founded in 2020 by two former Wise executives, has officially unveiled its new ISA offerings in the United Kingdom—both a Cash ISA and a Stocks & Shares ISA. These launches come hot on the heels of Lightyear’s recent FCA authorisation, a significant milestone that positions the company to challenge traditional providers like Hargreaves Lansdown, AJ Bell, and the familiar high-street banks most UK savers have used for decades. With a mission to help you reach financial freedom faster, Lightyear is bringing new transparency, lower fees, and flexible options to the table at a time when many consumers feel locked into outdated savings or investment platforms.

Lightyear’s UK CEO, Wander Rutgers, sums it up well:

At the moment the market is a lottery: most Brits sleepwalk into this lottery by opening an ISA with whoever they’ve been banking with since they were a kid.

For many savers and investors, those words may ring true. Despite an ever-growing array of fintech offerings, many people still default to a bank or long-established provider for their ISA without stopping to consider how much interest or how many fees they might be missing out on. Lightyear wants to shake up this complacency, calling it the “herd mentality.” The company believes a new era of flexible, user-friendly, and fair pricing has arrived—one in which the light truly shines on customers’ best interests, rather than on hidden charges or complicated rates.

Why Lightyear though?

At its core, Lightyear states that every product or investment it launches is driven by the same goal: to help you find financial freedom a little bit faster. That’s an ambitious aim, but the company’s steady expansion across 22 European markets—and a funding haul of $35 million to date—suggests a noteworthy appetite for disruption. Having secured approval from the Financial Conduct Authority (FCA) in the UK, Lightyear can now offer its own investment products on home turf. No longer just a general investment account or business account provider, it can now serve retail customers with the comprehensive range of ISAs required in the British market.

Lightyear’s UK Chief Executive, Wander Rutgers, insists that this is about giving savers and investors a dependable, cost-effective alternative that cuts out the guesswork. He wants people to “shop around” for their ISA, rather than settling for the nearest provider. The idea is that consumers should treat their ISA like any other product—search for the best rates, weigh up the fees, and leave behind the baggage of brand loyalty if it means getting a better deal.

Finance is in the business of trust… there are enough reasons to bank with a neo bank. Removing the reasons for people not to switch is about trust.

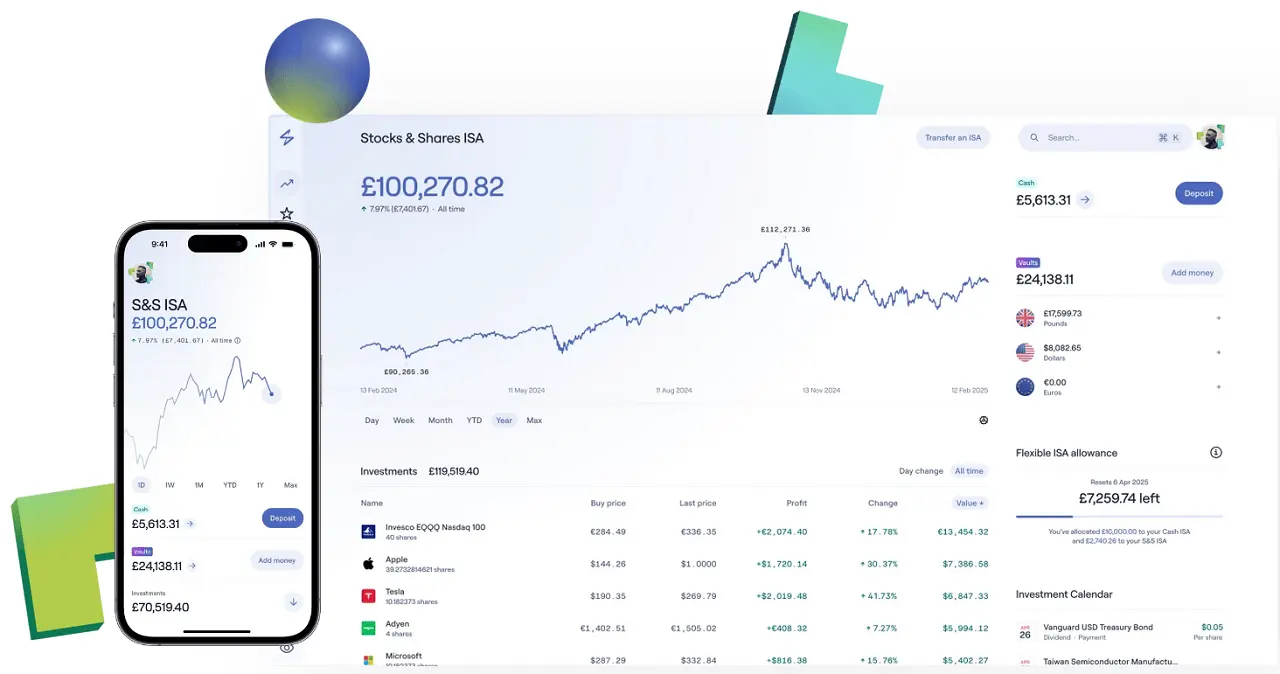

Of Lightyear’s two new ISA offerings, the Stocks & Shares ISA is the one that plays most directly to the company’s original strengths. Lightyear started as an investment platform back in 2021, and over time has introduced numerous handy tools—everything from intuitive charting and access to earnings calls on-the-go, to deep dives into company fundamentals and more. Bringing that same accessible, user-friendly approach to an ISA felt like a logical next step.

According to Lightyear’s collaboration with the independent macroeconomic research firm Capital Economics, the Lightyear Stocks & Shares ISA is 10 times cheaper than the market average over a 10-year horizon. That figure leaps to 16 times cheaper over a 25-year period, with typical ISA holders potentially paying over £11,000 in fees over that longer timeframe versus around £670 for Lightyear. These statistics are meant to highlight just how damaging fees can be for the long-term growth of your portfolio—something that often remains obscured or downplayed by more expensive ISA providers.

In terms of practicality, Lightyear’s Stocks & Shares ISA has no account fees, no subscription fees, no custody fees, and crucially no withdrawal fees either. That’s important if life throws you a curve ball and you need your money sooner than you originally planned. In addition, there’s no minimum amount to open. You can buy and sell more than 3,500 stocks and funds, with popular ETFs free of execution fees, while trades in US stocks cost just £/€/$1 (capped at 0.1% or $1). Given that fees represent one of the largest barriers to compounding your returns, Lightyear’s streamlined approach aims to make an immediate impact on your bottom line.

Flexibility is another major talking point. The ISA is “flexible,” meaning you can take money out and put it back in without losing any of your annual ISA allowance. For many investors, that can offer real peace of mind—knowing that if you move money around, you won’t reduce the remaining part of your £20,000 yearly allowance. The platform even provides interest through something called “Vaults,” backed by BlackRock, offering 4.84% AER (variable) for money market fund investments. So if you’re sitting on cash rather than stocks, you don’t have to watch it idly collect dust—Lightyear will help it earn interest.

Introducing the 4.75% Cash ISA

While a Stocks & Shares ISA might be a more advanced product, the truth is that many of us want or need a simple Cash ISA option, too. It can serve as a safer, short-term shelter for your savings, or the foundation of a broader investment plan. Lightyear’s Cash ISA currently pays 4.75% interest (AER), with the firm promising that its rate will directly track the Bank of England’s base rate. If the bank’s rate goes up, so does Lightyear’s. If it goes down, Lightyear’s follows suit.

One of the main reasons the Cash ISA market can feel bewildering is that it’s saturated with “flashy” temporary bonuses, complicated withdrawal rules, or hidden penalties in the small print. Lightyear says it wants to remove all of that complexity by offering a single rate pegged to the BoE. This means you don’t have to “rate shop” constantly, and you won’t get blindsided by half-baked promises that vanish in a few months’ time. In addition, you won’t be penalised if you decide to dip into your Cash ISA. There’s no limit on withdrawals; you can take money out whenever you like, with no hidden fees or interest penalties.

Another big selling point for savers is that the account is flexible—just like its Stocks & Shares sibling. Pull money out and put it back in the same tax year, and it won’t affect your annual allowance. You can open the ISA without any minimum deposit, and your money is held in a combination of UK banks and qualified money market funds (QMMFs). It’s precisely that stable environment that leads Lightyear to describe this as a “reliable rate,” because as the Bank of England changes course, so does Lightyear.

We think the peace of mind with a reliably moving rate might be the thing that pushes people to move to a fintech [from a traditional bank].

It’s worth noting that the best-buy rates on the market can sometimes be marginally higher than 4.75%. However, many come with strings attached, either via special promotions, temporary bonuses, or restrictions on withdrawals. That’s where Lightyear is attempting a different strategy—looking to offer you something that might not always be the highest figure on the day, but should remain strong and stable as it tracks one of the most important rates in the UK financial system.

Lightyear is acutely aware of its competition. Tech-savvy entrants like Robinhood or Revolut have made waves in the personal finance sphere, while longstanding platforms such as AJ Bell and Hargreaves Lansdown still control vast customer bases. Meanwhile, the big-name high-street banks are often the first and most obvious choice for the vast majority of people—especially if their family has used that same bank for generations.

That peace of mind is what Lightyear sees as its biggest selling point. There’s a sense that in a digital age, consumers have the ability to shop around for everything—from energy bills to streaming services—yet when it comes to finance, many remain reluctant to switch. Some of that is down to trust: do you trust a relatively new fintech with your ISA? Lightyear’s answer is that trust comes from transparency, and from a user experience that is straightforward, consistent, and free of the usual traps and fine-print catches.

In practice, a “herd mentality” often means you see the same ISA providers topping the popularity charts, year in and year out, simply because people rarely switch. Yet this inertia can cost the average saver hundreds of pounds in interest or fees. Lightyear cites data showing that the average Stocks & Shares ISA fee structure can cost you £481 more in interest each year, or up to £188 less in savings returns when you look at the average 3.6% interest rate in the Cash ISA market.

What next for Lightyear?

From its initial launch in 2021 to the full-scale UK relaunch last year, Lightyear has come a long way. The big difference now is that the company can offer regulated products under its own license, rather than acting as an appointed representative of another firm. That means bigger ambitions and more new products could be on the horizon. Indeed, Lightyear makes it clear that these new ISA products won’t be left to stagnate:

We’re not the sort of company that launches an important product and then leaves it untouched for years. We’ll be building and releasing more ISA features over the coming weeks, so watch this space.

Flexibility, transparency, and a “no surprises” attitude form the backbone of Lightyear’s approach—and that resonates in every detail of its new ISA offerings. It’s not trying to lock you in with punitive fees or time-limited rates; instead, it wants you to move your money freely while preserving the precious allowance that makes ISAs so popular in the first place.

If you do have suggestions or requests—be they additional market instruments, more niche portfolio tools, or new ways to monitor your money—Lightyear actively encourages you to reach out. The company wants to tailor its services to real customer needs, rather than second-guessing what the market wants.

Putting it all together

Ultimately, if you’ve still got some of your £20,000 yearly ISA allowance left and you’re shopping around for a flexible Cash ISA or a cost-effective Stocks & Shares ISA, Lightyear is now firmly in the running. The platform’s ambition is to unite the best parts of modern fintech—simple interfaces, greater transparency, minimal fees—with a robust regulatory framework and a stable, dependable interest rate for savers. For investors, that means lower long-term costs and a user-friendly environment. For savers, it’s a potential reduction in lost interest due to subpar rates.

We wanted to give you something that felt like Lightyear. Transparent, easy to understand and delightful to use.

That’s the heart of it. Whether or not Lightyear really can jolt people out of their “herd mentality” remains to be seen, but there’s a tangible sense of momentum and possibility in its new ISAs. As Rutgers and his team continue to develop both the Cash ISA and Stocks & Shares ISA with additional features, more British savers and investors may well find themselves questioning why they keep their money locked away with a big bank paying 1.8% or 3% interest—or an incumbent investment provider levying fee after fee.

At the end of the day, we have more financial choices than ever. Lightyear’s arrival in the UK ISA scene is a sign that competition can be good news for the consumer, shaking up decades of complacency and making financial freedom a little more within reach for everyone. If nothing else, the new era of flexible, “no surprises” ISAs might make you think twice before you automatically renew your ISA with the same provider you’ve always used. And in a world where every extra fraction of a percent matters, that moment of reflection—and potential saving—might be exactly what you need.

Happy ISA season, indeed. And, if Lightyear’s approach has you intrigued, it may be worth signing up to see if their “no subscription, no custody fee” approach really does make a difference over the long haul. At the very least, it’s refreshing to see a newer fintech stepping up to the big platforms and high-street names with a promise of more honesty, more transparency, and, yes, more light.