Wise (formerly known as TransferWise) and Pockit are two mobile banks that offer digital financial services to their customers. While both companies provide innovative features and user-friendly interfaces, they have different areas of focus and target audiences.

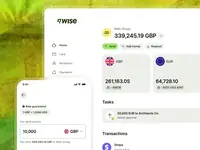

Wise is focused on providing international money transfers and currency exchange services, with its platform allowing users to send money internationally at low costs, with transparent fees and exchange rates. Additionally, Wise offers multi-currency accounts, debit cards, and a range of other financial services.

Pockit, on the other hand, is focused on providing banking services to underserved and financially excluded individuals in the UK, such as those with poor credit histories or those who are new to the country. Pockit offers a range of basic financial services, such as current accounts, debit cards, and cash withdrawals, with low fees and no hidden charges. Customers can also deposit cash at over 30,000 locations across the UK.

In terms of pricing, both Wise and Pockit offer low-cost accounts, with additional fees for certain services. Pockit also offers a premium subscription plan that includes additional features, such as cashback rewards and free international transactions.

Overall, both Wise and Pockit offer unique digital banking solutions that appeal to different customer segments. Wise may be more attractive to users who frequently send money internationally or need multi-currency accounts, while Pockit may be a better fit for users looking for low-cost banking services with accessible and convenient cash deposit and withdrawal options in the UK.