Wise (formerly known as TransferWise) and neon-free are two mobile banks that offer digital financial services to their customers. While both companies provide innovative features and user-friendly interfaces, they have different areas of focus and target audiences.

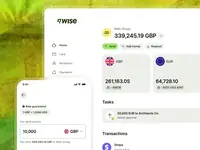

Wise is focused on providing international money transfers and currency exchange services, with its platform allowing users to send money internationally at low costs, with transparent fees and exchange rates. Additionally, Wise offers multi-currency accounts, debit cards, and a range of other financial services.

neon-free, on the other hand, is focused on providing a simple and accessible mobile banking experience, with features such as cashback on transactions, budgeting tools, and free cash withdrawals at over 10,000 ATMs across Switzerland.

In terms of pricing, both Wise and neon-free offer free basic accounts, with additional fees for certain services. neon-free also offers a premium subscription plan that includes additional features, such as higher cashback rewards and free international transactions.

Overall, both Wise and neon-free offer unique digital banking solutions that appeal to different customer segments. Wise may be more attractive to users who frequently send money internationally or need multi-currency accounts, while neon-free may be a better fit for users looking for a simple and accessible mobile banking experience with cashback rewards and budgeting tools.