Wise (formerly known as TransferWise) and Curve are two mobile banks that offer digital financial services to their customers. While both companies provide innovative features and user-friendly interfaces, they have different areas of focus and target audiences.

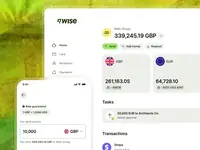

Wise is focused on providing international money transfers and currency exchange services, with its platform allowing users to send money internationally at low costs, with transparent fees and exchange rates. Additionally, Wise offers multi-currency accounts, debit cards, and a range of other financial services.

Curve, on the other hand, is focused on simplifying the user's financial life by consolidating multiple bank accounts and credit cards into a single platform. This allows users to access all their financial accounts from one place, and make payments using the Curve card, which can be linked to multiple accounts.

In terms of pricing, both Wise and Curve offer free basic accounts, with additional fees for certain services. Curve also offers a paid subscription plan that includes additional features, such as higher cashback rewards and travel insurance.

Overall, both Wise and Curve offer unique digital banking solutions that appeal to different customer segments. Wise may be more attractive to users who frequently send money internationally or need multi-currency accounts, while Curve may be a better fit for users looking for a platform that consolidates multiple accounts and simplifies their financial life.