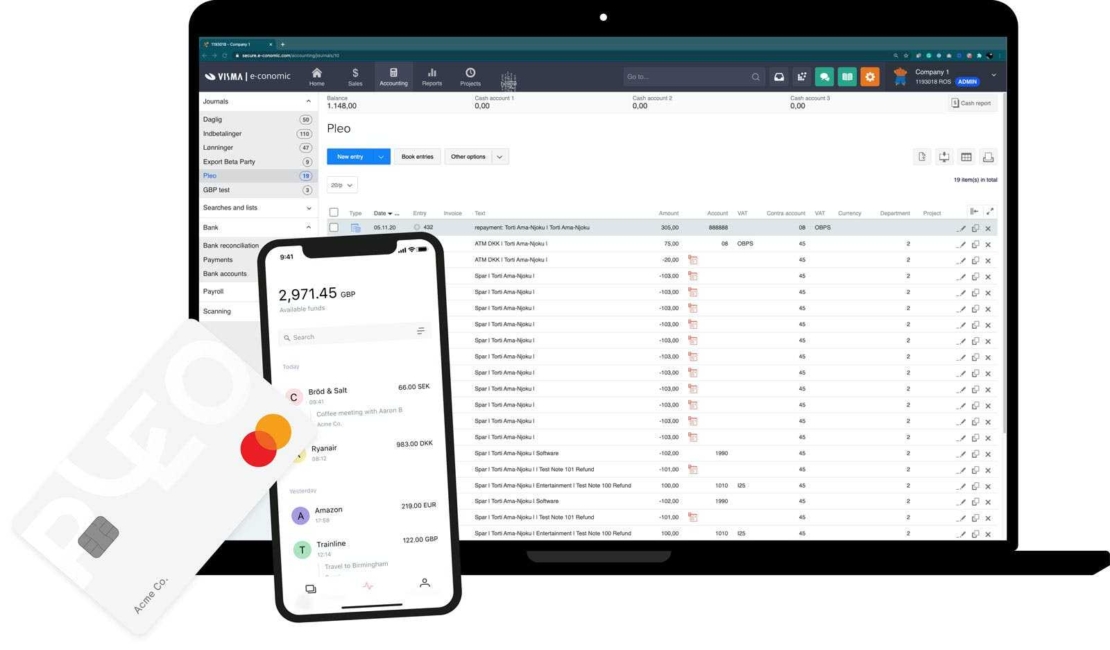

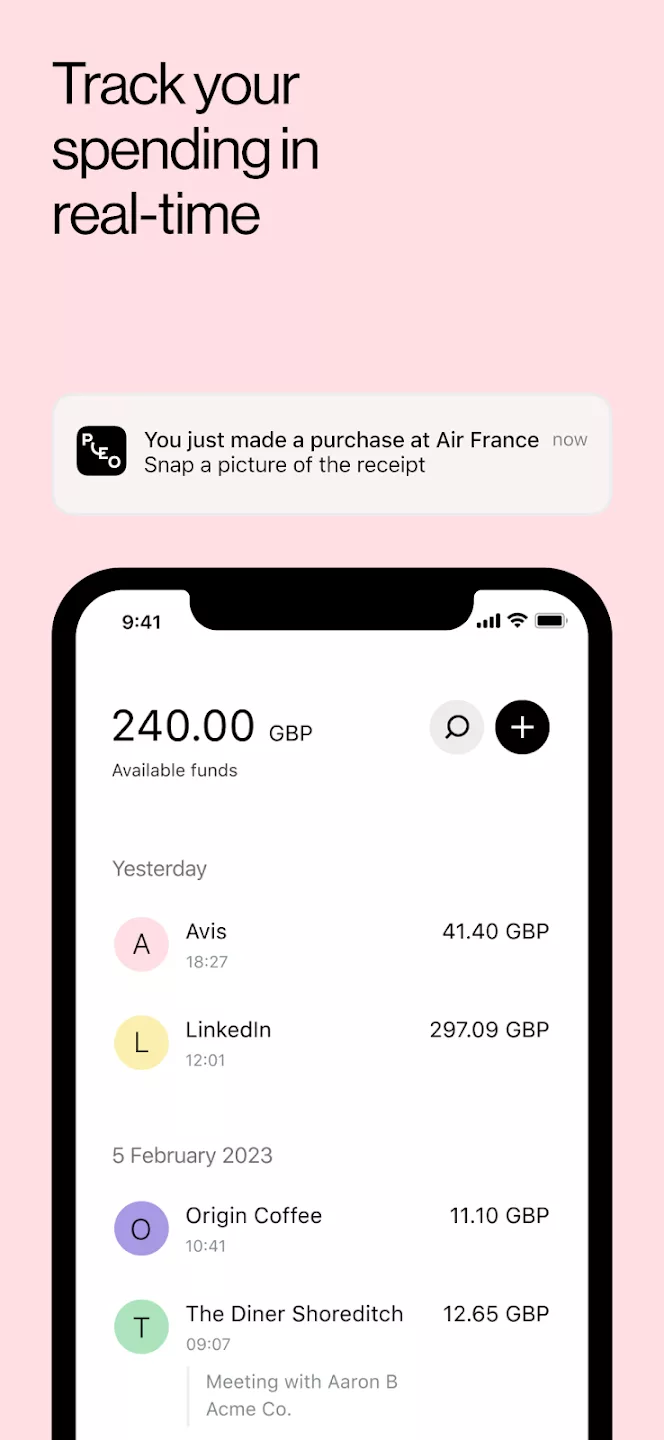

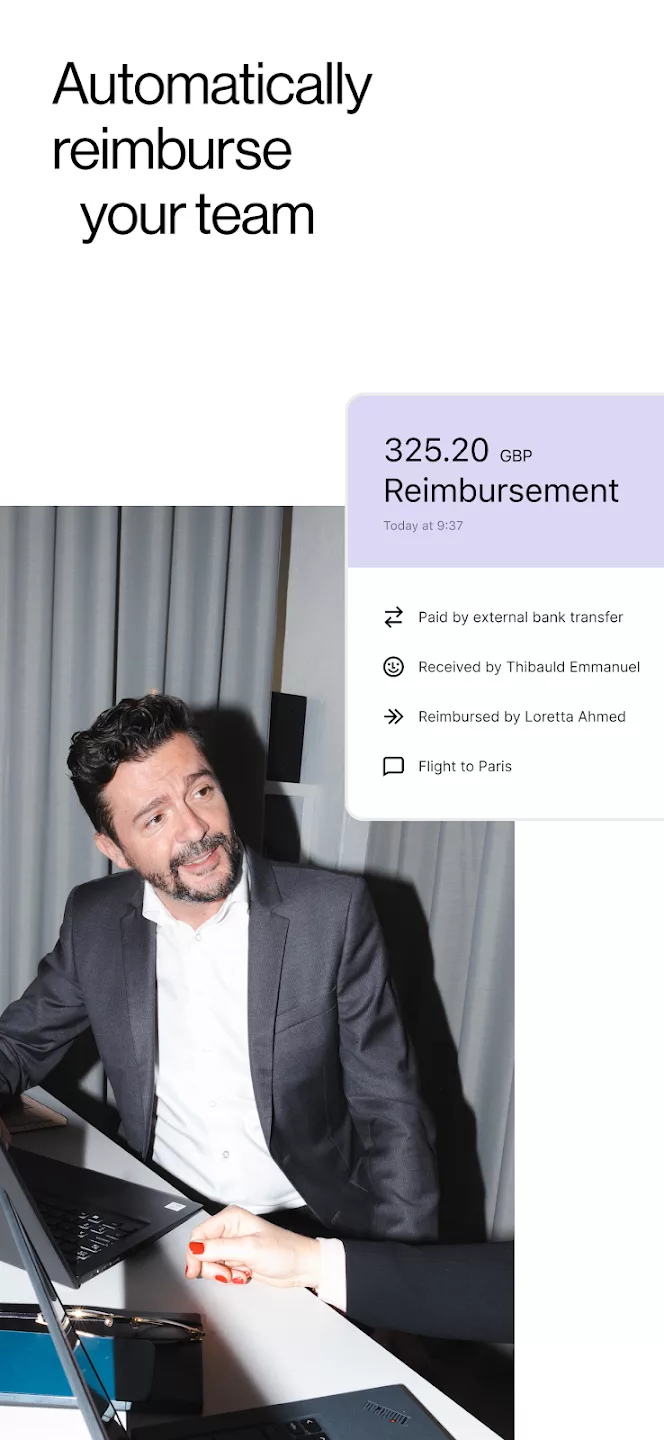

Business banking in France: A comprehensive look at Multipass, Wise, Qonto, and Pleo

This article delves into four prominent players in the business banking sector—Multipass, Wise, Qonto, and Pleo. We will explore their offerings, advantages, and how they compare.

Read more