Suits Me and Koho are two fundamentally innovative mobile banking services designed for ease, efficiency, and convenience, but they differ fundamentally in tailored user experience and services offered, primarily because they are designed for different markets.

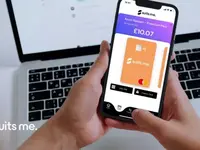

Suits Me, a UK-based mobile banking service, is designed to provide banking services to individuals, especially those who may struggle to open a conventional bank account due to their credit history or employment status. Their approach to banking includes an interface that is easy to navigate, making financial management simpler. Suits Me offers services like online banking, mobile banking, cashback rewards, instant notifications, UK-based customer service, and a Visa debit card, which is a globally recognized brand. One unique feature about Suits Me is its envelope budgeting tool that enables users to set up budgeting categories to better manage their finance. Further, Suits Me's ability, through their cashback rewards system, to earn up to 12% cashback at some selected retailers is also a noteworthy feature.

On the other hand, Koho, a Canadian fintech company, is designed to provide an alternative to traditional banking services. Like Suits Me, Koho also provides ease of banking through its mobile app and offers a Visa card. However, Koho goes a step further by providing budgeting tools, opportunities for financial coaching, round-up savings, financial insights, and joint accounts. It shines in its commitment to making banking transparent, by eliminating hidden fees and making savings more straightforward. The "round-up" system offered by Koho provides users with an easy way to save money by rounding up transactions to the nearest dollar and saving the difference.

While both seek to simplify banking and enhance user experiences, Suits Me provides a more targeted service for those struggling to open a traditional bank account and offers a great cashback reward system. Koho, in turn, caters to a wide audience market, offering transparency, savings help with the roundup feature, and financial coaching, providing a comprehensive financial education platform. Both are innovative in their own rights, offering capable alternatives to traditional banking services. Choosing between the two would depend predominantly on the user's geographical location (as each caters to different markets) and specific financial needs.