Suits Me and Vivid are two highly contemporary mobile banking platforms that offer a wide range of unique and customer-friendly services. However, these two platforms differ significantly in terms of structure and functionality.

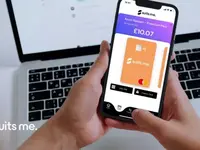

Suits Me is a financial solution designed primarily for temporary, contract, and freelance workers, as well as those unable to open traditional high-street bank accounts. Offering UK-based banking services, it aims to effectively meet the customers’ needs with features like cash back rewards with certain retailers, salary payments, bank transfers and personal IBANs. Importantly, it adheres to the common banking security measures for safe digital transactions.

In contrast, Vivid Money is a Berlin-based digital banking platform, targeting customers who seek a seamless, advanced, and sign-up free banking experience. Vivid offers advance saving, spending and investment opportunities, encapsulated in an interactive and user-friendly interface. What sets Vivid apart is its innovative feature of “pockets” which lets users categorize their money depending on their budgeting or savings goals. Another distinguishing feature is their stock trading and ETFs investment options, which is not offered by Suits Me.

Both platforms do not require credit checks, thus eliminating barriers that often make traditional banking inaccessible for some individuals. Both offer a free tier of service, though Suits Me also offers two paid subscription models with additional benefits.

In terms of geographical reach, Vivid might be more appealing to those who frequently travel or transact in Europe due to their cost-free withdrawals and payments in foreign currencies. On the other hand, Suits Me caters primarily to a UK audience and offers cash rewards on shopping at UK retailers, which might be more in line with a local customer’s needs.

In summary, whilst both Suits Me and Vivid Money provide robust mobile banking solutions, the choice between the two ultimately depends on individual needs – whether one is seeking a user-friendly tool for effective money management within the UK, or a broader platform for global transactions paired with investment functionalities.