Suits Me and Bnext, both part of the burgeoning mobile banking landscape, provide digital-first financial solutions, yet they cater to distinct audiences and have varied features. A closer look at both platforms reveals how they differ in their approach, services, and target demographics.

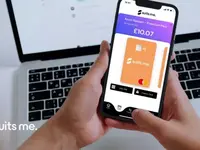

Suits Me, originating from the UK, serves as an inclusive banking alternative primarily for the underbanked segment of the population. Its services are tailored for individuals who might have faced challenges accessing traditional banking avenues, such as immigrants, freelancers, or those with minimal credit history. One of its standout features is the no-credit-check policy for account opening, ensuring a broader reach and accessibility. The Suits Me platform is designed for user-friendliness, catering especially to those who might be new to the concept of digital banking. Beyond basic banking services, users are provided with a contactless debit card that can be used internationally. This card also comes with the perk of cashback rewards from selected retailers, enhancing its utility for regular shopping. To further its customer-centric approach, multilingual customer service ensures a diverse user base feels catered to.

Bnext, on the other hand, hails from Spain and positions itself as the leading neobank in its home country. Unlike traditional banks, Bnext offers an account without associated fees, providing a more transparent and cost-effective banking experience. Its platform stands out for its marketplace feature, where users can access various financial products such as insurance, loans, and investment opportunities, all sourced from third-party providers. This model ensures that users have a broad spectrum of financial tools and services at their fingertips, all integrated within a single app interface. Bnext also supports instant transaction notifications and offers a currency exchange service without hidden fees, appealing particularly to travelers and those managing multicurrency transactions.

In summation, while both Suits Me and Bnext offer commendable mobile banking solutions, they cater to different needs. Suits Me focuses on inclusivity and accessibility, striving to democratize digital banking. In contrast, Bnext offers a comprehensive financial marketplace, prioritizing choice and integration of multiple services for its users. The decision between the two hinges on individual needs, banking preferences, and geographical considerations.