Wallester Business and Payhawk are both corporate card and expense management platforms used by finance teams across Europe. They help businesses issue cards, automate workflows, control spending, and track expenses in real time.

However, there are some significant differences between the two.

In this comparison, we’ll look at how the platforms stack up across key areas like pricing, onboarding, currency exchange, and accounting integration so you can decide which one fits your business better.

Company Overview

Wallester Business

Founded: 2016

Headquarters: Estonia

Presence: EEA and UK

Key Services: Virtual & physical corporate cards, real-time expense tracking, flexible payment solutions, API integrations

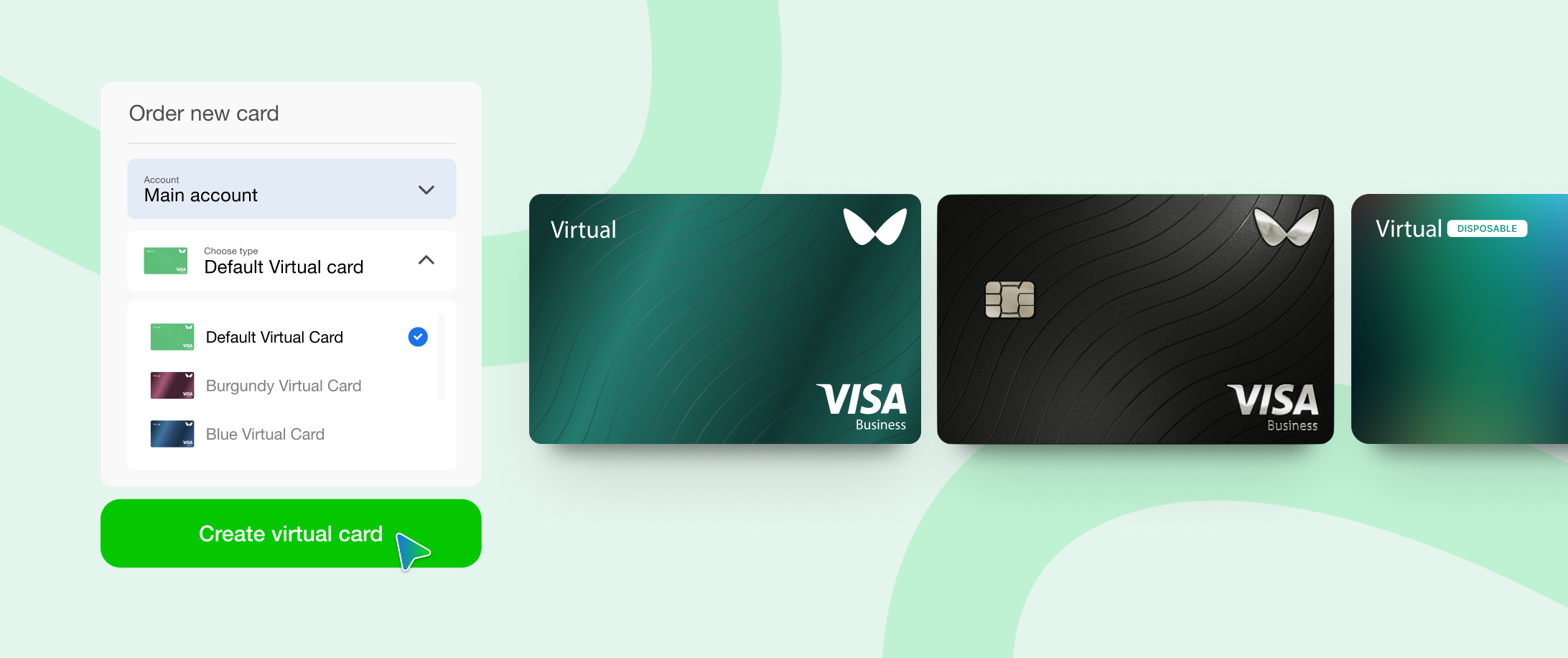

Wallester Business provides companies with virtual and physical Visa cards, real-time expense tracking, and advanced control features — all within a single platform. Businesses can issue up to 300 virtual Visa cards for free, add unlimited users, and manage all expenses from a central dashboard. The platform includes built-in accounting integrations, multi-currency features, and full control over team spending. It’s designed for finance teams that need flexibility, speed, and visibility across all transactions.

Payhawk

Founded: 2018

Headquarters: UK/Bulgaria

Presence: EEA and UK

Key Services: Virtual and physical card issuance, expense tracking, spend controls, invoice and bill management, ERP integrations, accounting automation

Payhawk is a paid spend management platform that combines card issuance with expense tracking, invoicing, and accounting automation. Businesses can issue virtual and physical cards, apply granular spend controls, and manage bills and reimbursements. Payhawk supports ERP integrations and offers additional modules like procure-to-pay and carbon emissions tracking, depending on the selected plan. It is primarily designed for companies with more complex accounting needs and the resources to implement an all-in-one system.

Features Comparison

| Feature | Wallester Business | Payhawk |

| Business Accounts & IBAN | No business accounts; just payment infrastructure | Full business banking with IBANs |

| Virtual & Physical Cards | Unlimited virtual & physical cards | Limited corporate debit cards |

| Card Issuance & Limits | 300 free virtual cards | Tier-based limits on card issuance |

| Cashback & Rewards | No cashback, but cost-saving with free cards | Cashback available on select plans; 1 in 4 customers earn enough to offset monthly fees (rate varies)

|

| Pricing & Subscription Fees | Free to use, custom pricing for advanced features | Paid plans only. Growth Programme starts at €149/month¹ |

| Expense Management | Real-time tracking, advanced controls | Integrated expense categorisation |

| Accounting Integrations | API-driven integrations for custom needs | Limited accounting tool integrations |

Customer Support Onboarding Currency Exchange | Dedicated business support Usually completed within one hour No fees for transfers between the company’s own accounts in 10 currencies | Multi-channel support Booking a demo with the sales team No fees for transfers between the company’s own accounts in 7 currencies |

¹ Payhawk’s Growth Programme is available to small businesses (<20 employees) registered in the EEA or UK. Includes 10 cards, 8 employee seats, 15 reimbursements/invoices per month.

Pros & Cons

Wallester Business

Pros:

- Scalable virtual and physical card issuance with no upfront costs

- Real-time transaction tracking and advanced spend control

- 300 free virtual cards and unlimited users

- No FX fees on internal transfers across 10 major currencies

- Fast onboarding (typically completed under 24 hours) with no subscription required

Cons:

- No business IBANs or invoice payment workflows

- Not suitable as a full replacement for traditional banking

Payhawk

Pros:

- All-in-one spend management with invoice, procurement, and card tools

- 0% FX fees in 7 currencies; supports credit and debit cards

- Advanced native integrations (NetSuite, Microsoft Dynamics, etc.)

- Multi-entity support and consolidated reporting

Cons:

- Tier-based pricing; subscription starts at €149/month (Growth Plan)

- Limited card issuance compared to Wallester’s free model

- Requires demo and sales process for onboarding

Which One Is Best for You?

If you’re looking to issue a high volume of cards, track spending in real time, and stay flexible as you grow then Wallester Business is the more agile and cost-effective option. With fast onboarding, no monthly fees, and full control over card settings, it’s particularly well suited to agencies, marketing teams, and companies managing distributed teams or multiple cost centres.

Payhawk may be a fit for companies that want a broader finance stack, including invoicing and procurement, and are willing to pay for deeper integrations and extended features. It offers a more traditional enterprise setup, with structured plans and bundled functionality.

Conclusion

Wallester Business and Payhawk serve different needs.

Wallester Business focuses on speed, scale, and transparency, giving finance teams the tools to issue cards instantly, control spend across teams, and simplify reconciliation without locking into complex pricing models.

Payhawk offers broader finance automation, but requires a greater upfront commitment — both in cost and implementation.

If you want lean, effective infrastructure that grows with your business, Wallester Business is the better choice.

Explore Wallester Business today and see how agile card infrastructure can support your finance operations across Europe.