For most finance teams, it’s a familiar and largely unquestioned reality: European businesses lose significant sums to fees on foreign exchange transactions that banks present as routine costs. For example, a UK company expanding into continental markets will typically pay 2–4% on conversions, and firms managing suppliers across multiple countries face pretty much the same charges on every cross-currency payment.

Wallester Business now removes these costs entirely — and is available to try at no charge via this link.

Banks fold these costs into exchange rates and add processing fees on top. But for businesses with regular cross-border operations, this translates to thousands of euros in annual charges that directly cut into profitability.

Introducing Zero-Fee Currency Exchange

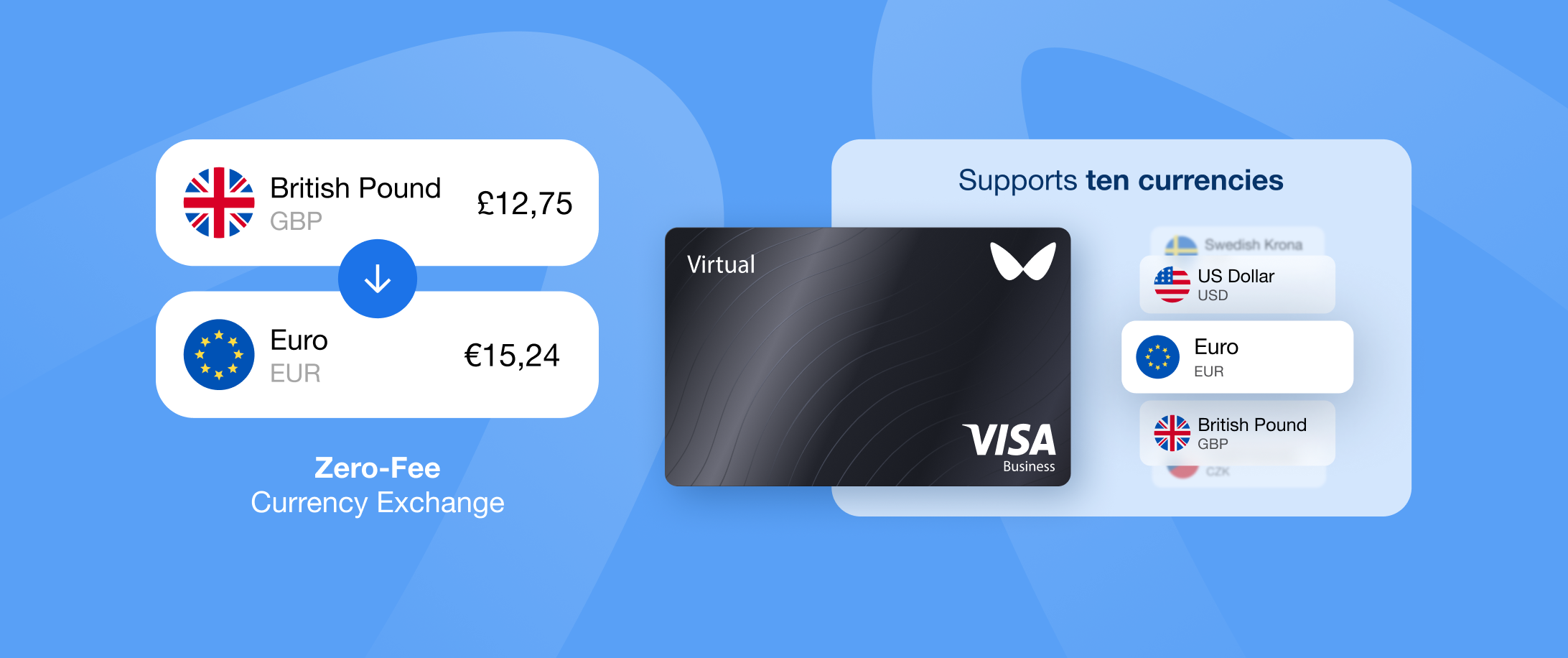

Wallester Business, an all-in-one corporate card issuance and expense management platform, has launched a currency exchange capability that removes these banking charges altogether. Now, the platform supports instant conversions across ten major currencies, with zero fees for transfers between a company’s own accounts.

Currently, the service supports ten currencies.

- EUR, GBP, USD

- SEK, NOK, CHF

- PLN, DKK, CZK, RON

The feature is available through both the Client Portal and Mobile App, allowing businesses to convert funds instantly as market conditions shift or operational needs arise. And unlike traditional banking processes, which can take several business days, Wallester’s exchange executes immediately, giving companies the flexibility to manage cash positions in real time.

Wallester Business also now enables currency account creation for clients who previously operated in a single currency, which opens the door to more sophisticated multi-currency strategies. It is particularly valuable for businesses that have relied on domestic operations but now require greater international flexibility.

Practical Benefits for Businesses

The cost savings are immediate and substantial. For instance, a company exchanging €50,000 monthly between EUR and GBP would typically pay €1,000–€2,000 annually in banking fees alone. Wallester’s zero-fee structure removes the cost altogether, converting what has long been an accepted friction of cross-currency business into measurable gains for the bottom line.

The feature simplifies operational complexity, too. Businesses can maintain dedicated currency accounts for different markets while transferring funds between them as needed. This removes the need to maintain relationships with multiple financial institutions or rely on external foreign exchange providers, each with their own fee structures and processing timelines.

In short, if you’re managing international advertising campaigns, supplier payments, or client billing across multiple currencies, Wallester’s zero-fee structure offers a clear operational advantage. Let’s take marketing agencies, for example — they can fund campaigns in local currencies without conversion delays. On the other hand, import–export businesses can optimise cash flow management across different markets.

Finally, the real-time nature of the exchanges enables more responsive financial management. When the EUR/GBP rate moves favourably, businesses can convert funds immediately rather than waiting for traditional banking processes or scheduling future exchanges through treasury departments.

Part of a Comprehensive Business Platform

Currency exchange feature addresses a specific cost pressure, but it is only one part of Wallester Business’s broader financial infrastructure. The platform combines corporate card issuance, real-time expense tracking and advanced spend controls in a single dashboard.

The free tier includes 300 virtual Visa cards with unlimited users and without time limits or hidden charges. Because businesses can issue dedicated payment methods for specific teams, projects or expense categories, they retain full oversight of all transactions. Physical cards meet traditional point-of-sale requirements, while virtual ones are suited to online purchases, subscription management and digital advertising.

There’s also real-time expense tracking that gives finance teams immediate visibility over spending patterns across accounts and currencies. Transactions post instantly to the dashboard with merchant information, currency details and categorisation.

Thanks to its REST API, Wallester Business integrates directly with accounting software such as Xero, QuickBooks and Sage. Therefore, month-end reconciliation, often a drain on accounting resources, becomes fast and simple.

The platform is fully compliant with European financial regulations, including GDPR, PCI DSS and PSD2. As a licensed Visa Principal Member, Wallester issues cards directly rather than through intermediaries. This improves processing reliability and reduces the risk of payment failures that can disrupt operations.

Why Choose an Integrated Approach

Traditional approaches to multi-currency business management involve multiple providers. Typically, it’s one bank for currency exchange, another for corporate cards, and third-party software for expense management.

With Wallester Business, you get all these functions within a single platform with transparent pricing and no hidden charges. The currency exchange feature works seamlessly with card issuance and expense management, giving you a unified view of financial operations across different markets and payment methods.

For European businesses, bringing payments, currency exchange and expense control under one roof cuts out unnecessary costs and complexity, leaving more time and capital for growth. Wallester Business delivers exactly that.

Explore Wallester Business today for free and discover how modern financial infrastructure can support your growth across European markets.