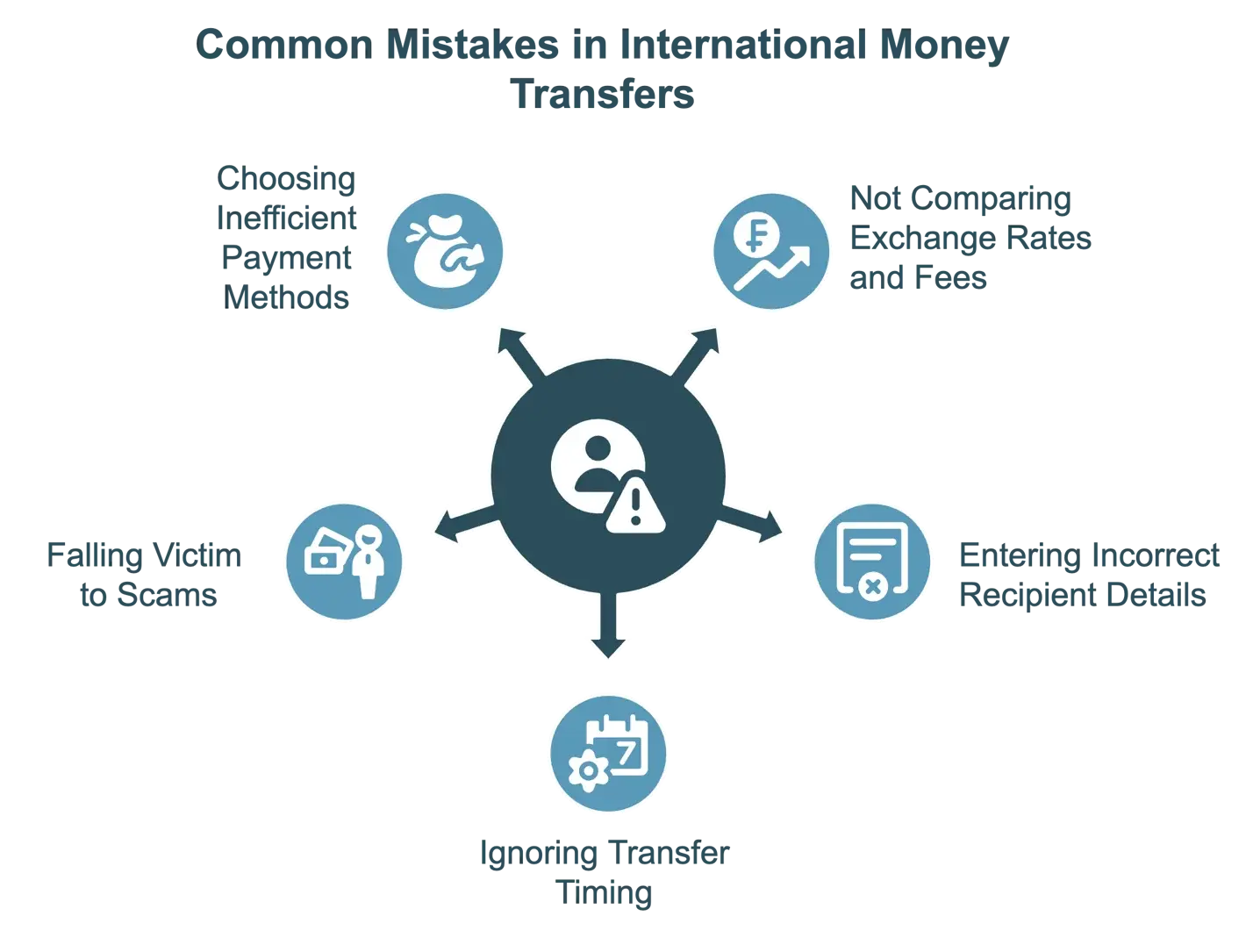

Sending money across borders has become a regular part of life for many people and businesses. Whether it’s supporting loved ones overseas, paying for property abroad, or settling invoices with international suppliers, cross-border payments are now more essential than ever. However, they can also be complicated and costly if you don’t navigate the process carefully. Small mistakes can lead to delays, hidden fees, or even lost funds. To help you stay on track, here are five common pitfalls to avoid—and how CurrencyFair can help you steer clear of them.

1. Failing to compare exchange rates and fees

One of the most frequent mistakes people make is not taking the time to compare exchange rates and transfer fees. Many banks still charge significant hidden fees and offer poor exchange rates, which means the recipient ends up with much less money than you intended. For instance, transferring £10,000 through a traditional bank could result in hundreds lost to fees and a subpar exchange rate.

To avoid this, always compare rates across several platforms using online tools. Opt for transparent providers like CurrencyFair, which offers bank-beating exchange rates and a flat transfer fee of just €3 (or the local currency equivalent). Tools like CurrencyFair’s rate alerts can also notify you when favourable exchange rates become available.

2. Entering incorrect recipient details

It may seem like a small oversight, but entering incorrect recipient information—such as misspelled names, wrong account numbers, or incorrect SWIFT codes—can cause serious delays or result in funds being sent to the wrong account. Fixing these errors can be time-consuming and costly, particularly in countries with strict banking regulations.

To prevent this, always double-check all recipient information before confirming a transfer. It’s also important to verify any formatting requirements for banking details specific to the recipient’s country. CurrencyFair makes things easier by allowing you to securely save recipient information for future use, reducing the chance of errors.

3. Ignoring transfer timing

Timing can have a major impact on the success of your international transfer. Exchange rates fluctuate constantly, and sending money on weekends or during public holidays can result in delays or missed opportunities for better rates. For example, a Friday evening transfer might not be processed until the following Monday due to limited bank hours.

Monitoring exchange rate trends and scheduling your transfer during optimal times can help. CurrencyFair’s rate alert tool is particularly useful for locking in great rates. It’s also important to be aware of public holidays in both your country and the recipient’s, as these can affect processing times.

4. Falling for scams

Unfortunately, international money transfers are often targeted by scammers. These fraudsters may pretend to be from banks, government agencies, or charities, tricking you into sending money to fraudulent accounts. One common scam involves fake emails urging users to make urgent transfers for account verification, only for the funds to end up in the wrong hands.

To protect yourself, only use regulated platforms like CurrencyFair, which are subject to strict financial oversight. Always verify the recipient’s identity before sending money and activate extra security measures, such as two-factor authentication, for your account. For more guidance on avoiding fraud, check out resources on spotting financial scams.

5. Using inefficient payment methods

Choosing the wrong payment method can significantly increase costs. Using a credit card, for instance, often involves higher fees than bank transfers or ACH payments. Some methods may also be unsuitable for large transactions, such as buying property abroad.

To save on fees and ensure smoother transfers, opt for efficient payment methods like ACH for USD or SEPA for Euro transfers. CurrencyFair supports a range of low-fee payment options tailored for large and small transactions alike. If you're planning a big purchase like property abroad, it’s especially important to use the most cost-effective method available.

Frequently Asked Questions

What’s the cheapest way to send money abroad?

Specialist services like CurrencyFair typically offer better exchange rates and lower fees than traditional banks, making them a more affordable choice for international transfers.

Are online money transfer services safe?

Yes—provided you choose reputable providers regulated by financial authorities. CurrencyFair, for example, uses advanced encryption and follows strict regulatory guidelines to keep your funds secure.

How can I get the best exchange rate?

Monitor exchange rates regularly and use tools like CurrencyFair’s rate alerts to time your transfers strategically. This helps you make the most of favourable fluctuations.

International money transfers don’t have to be difficult or expensive. By avoiding these five common mistakes—failing to compare rates, entering incorrect details, ignoring timing, falling for scams, and using inefficient payment methods—you can make the process smoother and more cost-effective. CurrencyFair offers a smarter alternative to traditional banks, with better exchange rates, low flat fees, robust security, and helpful tools like rate alerts.

Ready to make your next international transfer easier and cheaper? Sign up with CurrencyFair today and start saving.