Wallester Business vs Payhawk: Which business payment solution is right for you?

Wallester Business and Payhawk are both corporate card and expense management platforms. However, there are some significant differences between the two.

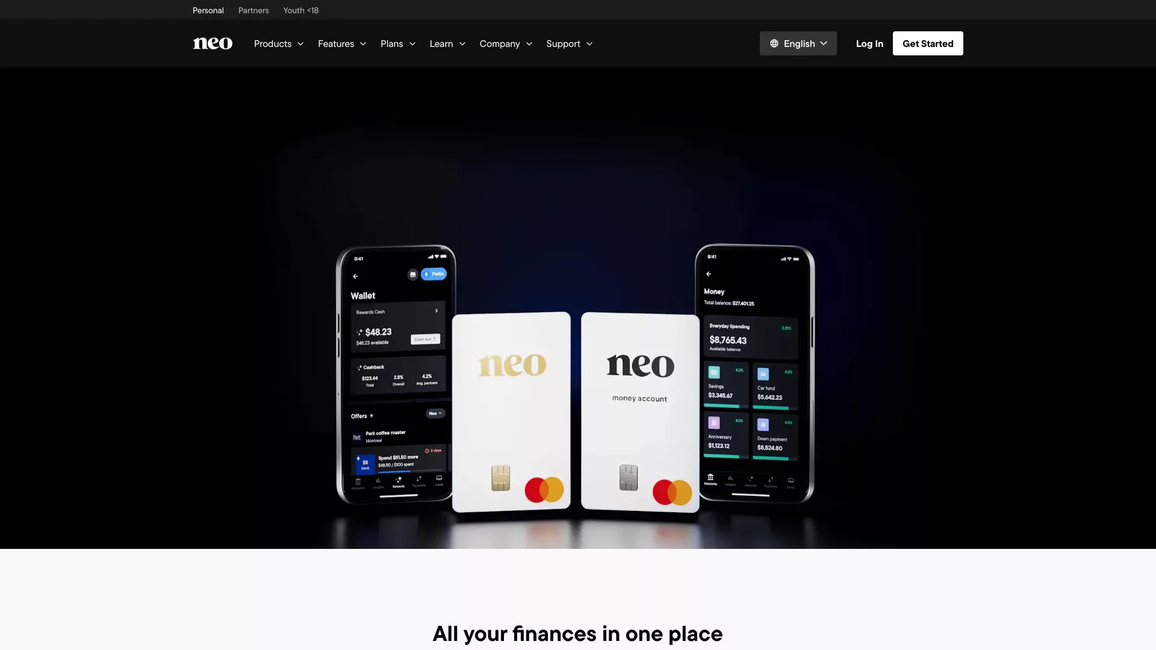

Read moreNeo Financial™ is shaping the future of how Canadians spend, save, and earn. Join now and discover a modern way to manage your money.

Go to Neo Financial Learn moreWe put every effort into ensuring information on Neolista is accurate. Double-check details that matter to you before opening an account.

Supported accounts:

PersonalA trusted, all-in-one rating that simplifies feedback from across the web.

Neo Financial is a modern mobile banking platform designed to provide a seamless and intuitive banking experience for its users. This technology-driven bank leverages the latest fintech advancements to offer personalized financial services that fit the lifestyles of contemporary consumers. With a strong emphasis on user-friendliness, Neo Financial aims to simplify banking by providing a sleek, easy-to-navigate app that allows customers to handle their banking needs anytime, anywhere.

The platform offers various features including high-interest savings accounts, zero monthly fees, rewards on everyday spending, and advanced security measures to protect users' information. Neo Financial's approach is customer-centric, focusing on flexibility and convenience with a suite of financial tools that help users manage their finances effectively. By using Neo Financial, customers can enjoy a banking experience that aligns with the digital age, characterized by quick setup, real-time notifications, and insightful financial tracking.

Go to Neo FinancialExplore what real users have to say about their experiences with Neo Financial. These 5-star reviews showcase the exceptional service and satisfaction provided by this neobank, giving you insight into why it's a top choice for customers worldwide.

I usually don't leave reviews, but I felt compelled to after reading the other reviews. It's unfortunate that many of the negative comments come from individuals who may not fully understand how neo banks function. They would likely be better served by traditional brick-and-mortar banks. All neo banks offer similar products to traditional banks, but they operate differently. It's crucial to do your research before signing up, as there are variations in rates and services among neo banks. People need to take responsibility for informing themselves and managing their finances. Personally, I have never had any issues with Neo Financial's customer service. Setting up my accounts was simple and straightforward, and the app is easy to use and navigate. The website is just as user-friendly. Their High-Interest Savings Account has earned me a lot of interest. It’s important to remember that managing finances is ultimately your responsibility. If you overspend, that's on you for accruing fees. Any issues with transactions should be addressed directly with the retailer. Also, banks are required by law to retain your information for five years, so closing an account doesn’t mean your personal information is deleted immediately. When reading reviews, a little common sense goes a long way in distinguishing between what is reasonable and what is not. Neo banks, like Neo Financial, Motus, Tangerine, and EQ, are quite different from traditional banks and may not be suitable for everyone. I personally use both RBC and Neo and find that I can make the products and services work for me quite effectively. Transferring money electronically between banks is free and easy. With notifications, it's simple to keep track of transactions and bill due dates. You can set alerts for low account balances and nearing credit limits, as well as pre-authorized payments for credit cards and utilities. Just to clarify, I am neither a Neo Financial employee nor a banking advisor.

01/07/2024

I've been using NEO Bank for a year now, and so far, I'm really satisfied. Their HISA account offers a 4% interest rate, which is better than the 6-month GIC rates at other banks. Plus, it's a cash account, so I can withdraw money anytime! I don't understand why others rated NEO Bank only 1.5 stars; I would give them a solid 5-star rating.

20/04/2024

While it seems like some employees may have left glowing reviews, the truth is that this bank is actually quite good. Switching from one bank to another can be a hassle, but instead of paying $15 a month, I now receive around $40. The benefits of making the change are well worth it.

06/07/2023

Amazing customer service—patient, communicative, and always prompt. I used Neo for my mortgage loan, and we all know how stressful buying a home can be, especially in this climate. Al was incredibly supportive and helpful, and it was evident he was doing everything possible to guide me through the process and answer all of my questions. I had considered going with a local broker, but I'm glad I chose Neo.

28/02/2023

Great rates and an easy-to-use app. No issues with customer support. A 4% rate on a HISA that isn't a promotional offer is excellent!

13/02/2024

Explore our comprehensive collection of blogs that delve into Neo Financial and the world of mobile banking.

Wallester Business and Payhawk are both corporate card and expense management platforms. However, there are some significant differences between the two.

Read moreWallester Business, an all-in-one corporate card issuance and expense management platform, has launched a currency exchange capability that removes these banking charges altogether.

Read moreFor years, that cash sat in the same high-street banks grandma used: branch queues, paper token readers, invoices reconciled by hand on a Friday night. Spain, almost overnight, has become one of Europe’s most interesting laboratories for digital business money.

Read moreStill have a few things you'd like to clear up? We've put together the following simple answers to questions frequently thought, but rarely asked.

Neo Financial is a modern mobile banking platform designed to provide a seamless and intuitive banking experience for its users. This technology-driven bank leverages the latest fintech advancements to offer personalized financial services that fit the lifestyles of contemporary consumers. With a strong emphasis on user-friendliness, Neo Financial aims to simplify banking by providing a sleek, easy-to-navigate app that allows customers to handle their banking needs anytime, anywhere.

The platform offers various features including high-interest savings accounts, zero monthly fees, rewards on everyday spending, and advanced security measures to protect users' information. Neo Financial's approach is customer-centric, focusing on flexibility and convenience with a suite of financial tools that help users manage their finances effectively. By using Neo Financial, customers can enjoy a banking experience that aligns with the digital age, characterized by quick setup, real-time notifications, and insightful financial tracking.

Neo Financial is currently available for residents of the following countries:

CanadaNo matter where you are, at home or abroad, you can access your Neo Financial account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

Opening an account with Neo Financial is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Neo Financial doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

Another main reason to use Neo Financial is the low (or no!) fees. Neo Financial has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, Neo Financial offers zero fees on all transactions, including purchases made overseas!

Neo Financial = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Neo Financial everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.