Wallester Business vs Payhawk: Which business payment solution is right for you?

Wallester Business and Payhawk are both corporate card and expense management platforms. However, there are some significant differences between the two.

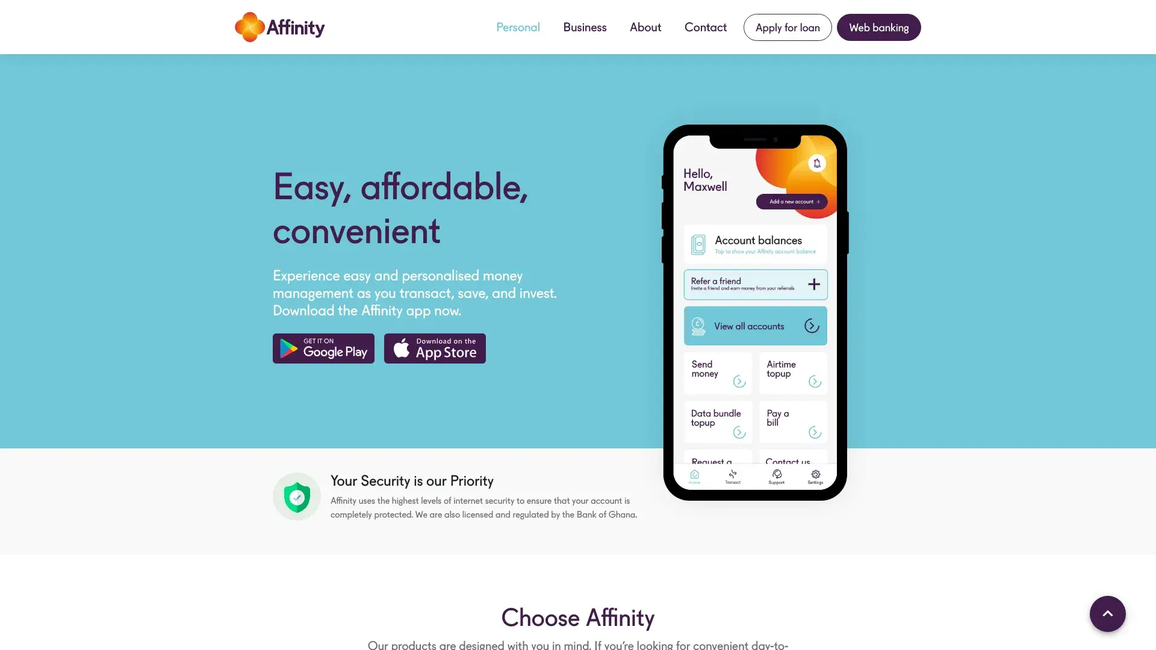

Read moreExperience easy and personalised money management as you transact, save, and invest.

Go to Affinity Learn moreWe put every effort into ensuring information on Neolista is accurate. Double-check details that matter to you before opening an account.

Supported accounts:

Business PersonalA trusted, all-in-one rating that simplifies feedback from across the web.

Affinity is a cutting-edge neobank designed to meet the evolving demands of modern banking with seamless digital experiences. Focused on providing personalized financial services, Affinity empowers users to manage their finances with ease through an intuitive and user-friendly platform.

The platform offers a robust suite of services including checking and savings accounts with competitive interest rates, instant peer-to-peer payments, and zero-fee transactions. Utilizing advanced AI-driven analytics, it provides users with personalized insights to optimize their financial health and achieve their savings goals.

Affinity prioritizes security and privacy by incorporating bank-grade encryption, biometric authentication, and real-time fraud monitoring to ensure that users' data and funds remain safe and secure.

With a commitment to sustainability, Affinity implements environmentally responsible practices and encourages paperless transactions, aligning with eco-conscious users' values.

Designed for integration, Affinity seamlessly connects with other financial applications, enabling users to have a comprehensive overview of their financial ecosystem. Moreover, their dedicated customer support team is available 24/7 to offer assistance and address any inquiries promptly.

By blending innovation, security, and customer-centric features, Affinity defines the future of banking, creating relationships that go beyond traditional financial interactions. Users can access their accounts anytime, anywhere, offering the ultimate flexibility and convenience in financial management.

Go to AffinityExplore our comprehensive collection of blogs that delve into Affinity and the world of mobile banking.

Wallester Business and Payhawk are both corporate card and expense management platforms. However, there are some significant differences between the two.

Read moreWallester Business, an all-in-one corporate card issuance and expense management platform, has launched a currency exchange capability that removes these banking charges altogether.

Read moreFor years, that cash sat in the same high-street banks grandma used: branch queues, paper token readers, invoices reconciled by hand on a Friday night. Spain, almost overnight, has become one of Europe’s most interesting laboratories for digital business money.

Read moreStill have a few things you'd like to clear up? We've put together the following simple answers to questions frequently thought, but rarely asked.

Affinity is a cutting-edge neobank designed to meet the evolving demands of modern banking with seamless digital experiences. Focused on providing personalized financial services, Affinity empowers users to manage their finances with ease through an intuitive and user-friendly platform.

The platform offers a robust suite of services including checking and savings accounts with competitive interest rates, instant peer-to-peer payments, and zero-fee transactions. Utilizing advanced AI-driven analytics, it provides users with personalized insights to optimize their financial health and achieve their savings goals.

Affinity prioritizes security and privacy by incorporating bank-grade encryption, biometric authentication, and real-time fraud monitoring to ensure that users' data and funds remain safe and secure.

With a commitment to sustainability, Affinity implements environmentally responsible practices and encourages paperless transactions, aligning with eco-conscious users' values.

Designed for integration, Affinity seamlessly connects with other financial applications, enabling users to have a comprehensive overview of their financial ecosystem. Moreover, their dedicated customer support team is available 24/7 to offer assistance and address any inquiries promptly.

By blending innovation, security, and customer-centric features, Affinity defines the future of banking, creating relationships that go beyond traditional financial interactions. Users can access their accounts anytime, anywhere, offering the ultimate flexibility and convenience in financial management.

Affinity is currently available for residents of the following countries:

GhanaNo matter where you are, at home or abroad, you can access your Affinity account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

Opening an account with Affinity is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Affinity doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

Another main reason to use Affinity is the low (or no!) fees. Affinity has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, Affinity offers zero fees on all transactions, including purchases made overseas!

Affinity = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Affinity everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.