Wallester Business vs Payhawk: Which business payment solution is right for you?

Wallester Business and Payhawk are both corporate card and expense management platforms. However, there are some significant differences between the two.

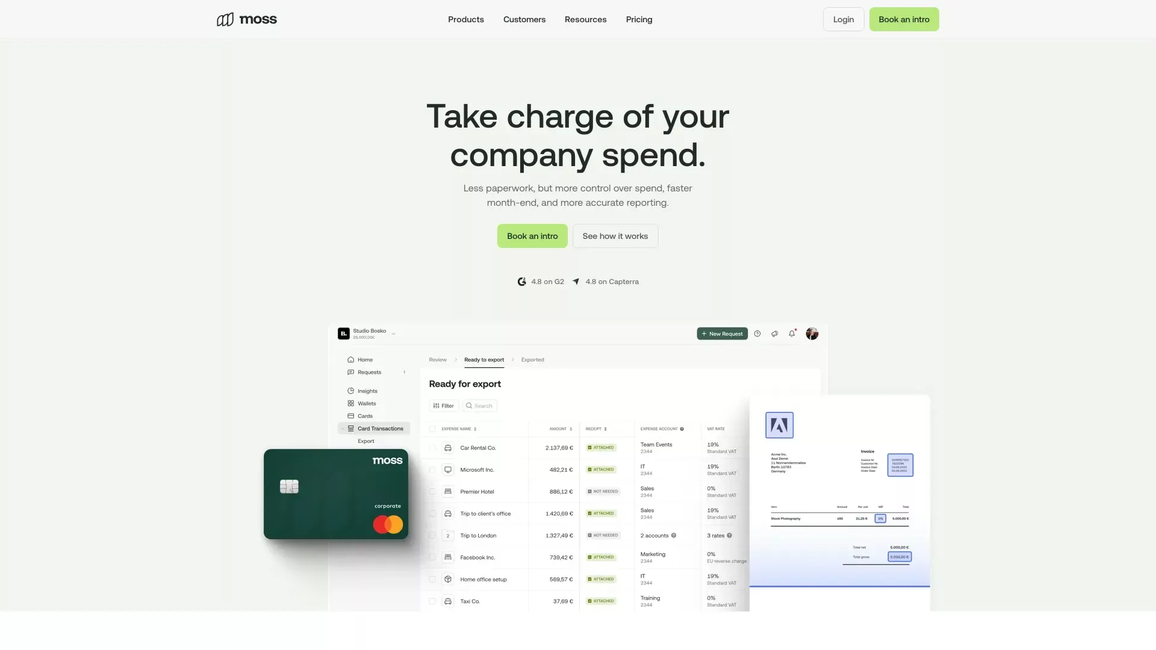

Read moreCapture receipts easier, automate expense categorisation, and seamlessly sync with your accounting system to close the books in a fraction of the time.

Go to Moss Learn moreWe put every effort into ensuring information on Neolista is accurate. Double-check details that matter to you before opening an account.

Supported accounts:

BusinessA trusted, all-in-one rating that simplifies feedback from across the web.

Moss is an innovative mobile bank designed for modern businesses looking to streamline their financial operations. This digital banking platform provides a comprehensive suite of services that are tailored to the needs of startups, freelancers, and growing companies. With its user-friendly interface, Moss allows for easy management of finances directly from a smartphone or other mobile devices.

One of the central features of Moss is its smart corporate credit cards, which enable team members to make secure business transactions while allowing administrators to maintain control and visibility over expenses. The platform also offers real-time spending tracking, expense categorization, and integrated receipt capture to simplify expense reporting and budgeting.

Moreover, Moss supports multi-account management, facilitating efficient handling of multiple currencies, and seamlessly integrates with leading accounting software to automate financial workflows. Its powerful analytics tools aid in financial forecasting and decision-making, providing users with insights that help optimize cash flow and reduce costs.

Keeping security at the forefront, Moss ensures that all banking data is protected with industry-standard encryption and cybersecurity measures. Additionally, Moss stands out with its dedication to providing exceptional customer support, ensuring that users have access to assistance whenever needed.

In summary, Moss represents a modern solution for business banking, combining convenience, control, and intelligent features to help companies manage their finances more effectively in today's fast-paced digital environment.

Go to MossExplore what real users have to say about their experiences with Moss. These 5-star reviews showcase the exceptional service and satisfaction provided by this neobank, giving you insight into why it's a top choice for customers worldwide.

I really enjoy using Moss. It's one of the best accounting software tools for Accounts Payable. User-friendly and versatile, it makes pre-booking incredibly easy. A significant advantage is the ability to easily deploy credit cards to employees within the company. I also love the automated matching of receipts to card transactions. Best of all is the Moss team—they genuinely consider our feedback and are open to making changes to improve the tool even further. This responsiveness makes them an excellent partner.

29/03/2023

MOSS is extremely powerful. It provides a great overview of all transactions and allows automatic linking of invoices, which is a fantastic feature. I also love that new improvements are rolled out automatically. Plus, the support is exceptional!

15/01/2024

I have been using Moss for over a year and have firsthand experience with their regular updates and new feature launches. All features are thoughtfully developed, clearly structured, and very intuitive to use. As the Head of Finance, Moss has made my life so much easier. Their customer support team is excellent, responding to my inquiries within minutes. I look forward to more features and a great partnership in the future.

25/01/2023

The platform is excellent! It's clear, user-friendly, and offers a wide range of features. One standout feature is the ability to upload invoices easily through a photo using the app. The platform is also well designed for accounting preparation, allowing for instant entry of VAT and G/L accounts. Additionally, the "Reimbursement" feature is quick and easy to use. Exporting reports is a breeze as well. I highly recommend moss!

15/03/2023

Moss has significantly improved our efficiency, allowing us to close our books within days. The automation of our expenses through the platform has helped us semi-automate much of our bookkeeping and reconciliation work. Their dedication and support for early-stage companies truly make a difference. I highly recommend Moss for companies of all sizes!

02/12/2021

Explore our comprehensive collection of blogs that delve into Moss and the world of mobile banking.

Wallester Business and Payhawk are both corporate card and expense management platforms. However, there are some significant differences between the two.

Read moreWallester Business, an all-in-one corporate card issuance and expense management platform, has launched a currency exchange capability that removes these banking charges altogether.

Read moreFor years, that cash sat in the same high-street banks grandma used: branch queues, paper token readers, invoices reconciled by hand on a Friday night. Spain, almost overnight, has become one of Europe’s most interesting laboratories for digital business money.

Read moreStill have a few things you'd like to clear up? We've put together the following simple answers to questions frequently thought, but rarely asked.

Moss is an innovative mobile bank designed for modern businesses looking to streamline their financial operations. This digital banking platform provides a comprehensive suite of services that are tailored to the needs of startups, freelancers, and growing companies. With its user-friendly interface, Moss allows for easy management of finances directly from a smartphone or other mobile devices.

One of the central features of Moss is its smart corporate credit cards, which enable team members to make secure business transactions while allowing administrators to maintain control and visibility over expenses. The platform also offers real-time spending tracking, expense categorization, and integrated receipt capture to simplify expense reporting and budgeting.

Moreover, Moss supports multi-account management, facilitating efficient handling of multiple currencies, and seamlessly integrates with leading accounting software to automate financial workflows. Its powerful analytics tools aid in financial forecasting and decision-making, providing users with insights that help optimize cash flow and reduce costs.

Keeping security at the forefront, Moss ensures that all banking data is protected with industry-standard encryption and cybersecurity measures. Additionally, Moss stands out with its dedication to providing exceptional customer support, ensuring that users have access to assistance whenever needed.

In summary, Moss represents a modern solution for business banking, combining convenience, control, and intelligent features to help companies manage their finances more effectively in today's fast-paced digital environment.

Moss is currently available for residents of the following countries:

Netherlands, United Kingdom, GermanyNo matter where you are, at home or abroad, you can access your Moss account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

Opening an account with Moss is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Moss doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

Another main reason to use Moss is the low (or no!) fees. Moss has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, Moss offers zero fees on all transactions, including purchases made overseas!

Moss = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Moss everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.