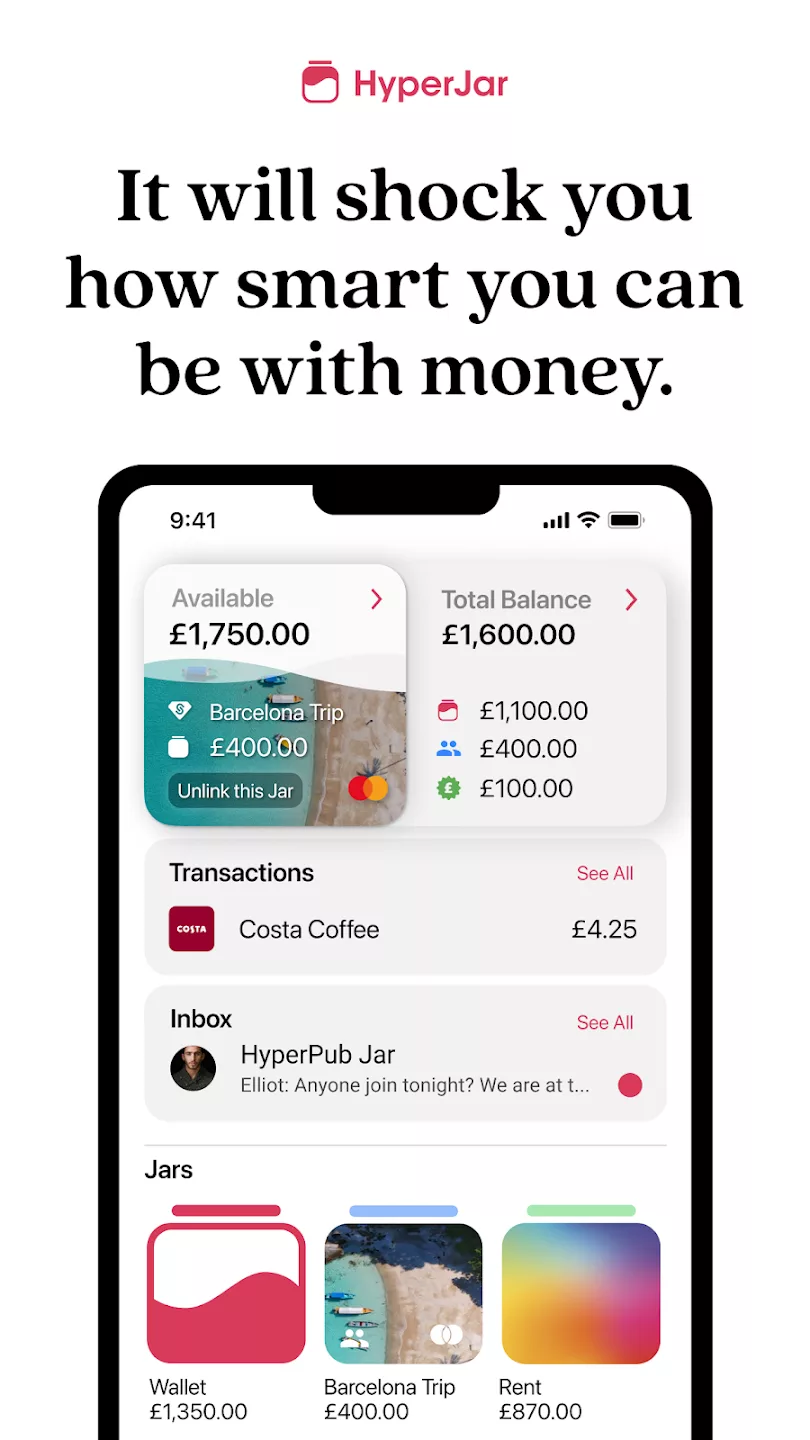

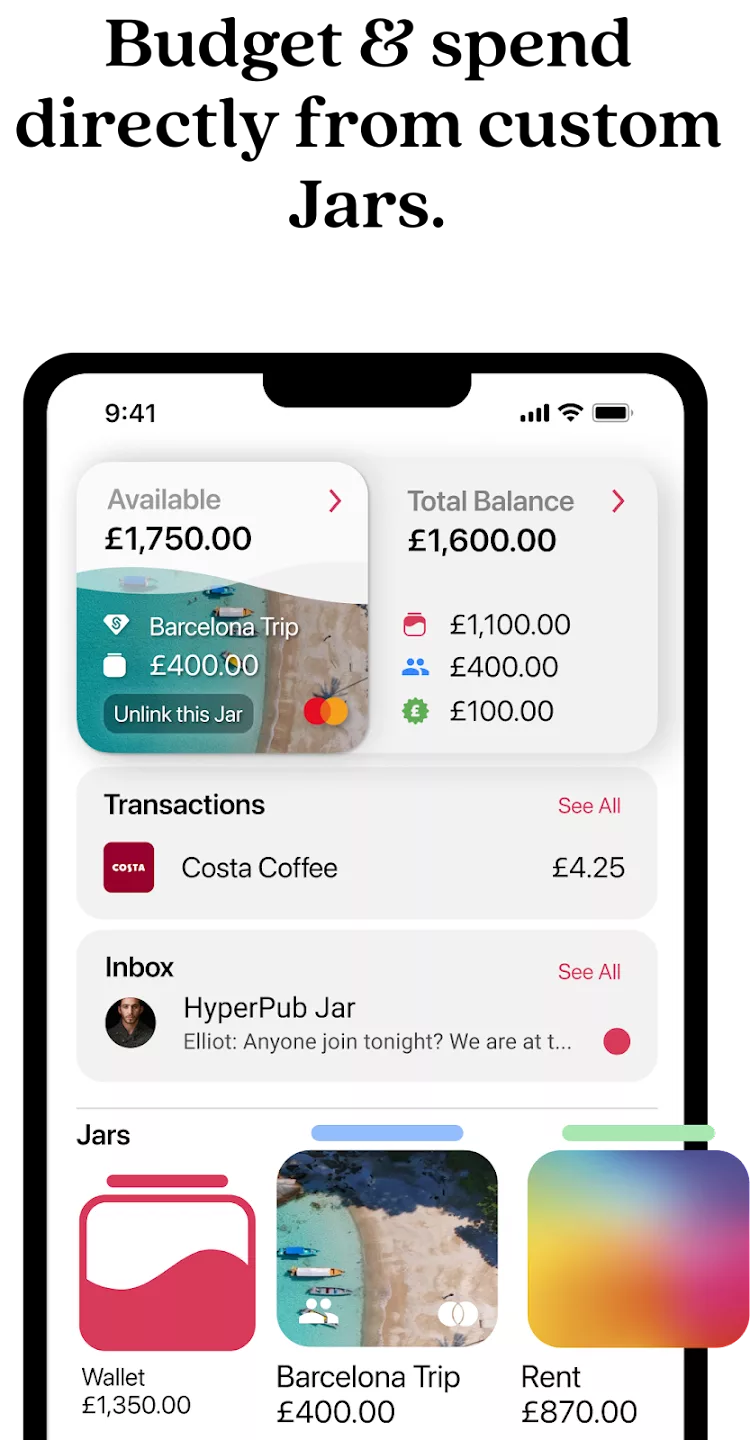

HyperJar is a mobile banking app that revolutionizes the way users manage their personal finances and plan their spending. Designed for those who wish to take control of their financial life, HyperJar promotes smart spending habits through the use of digital 'Jars' – individual accounts within the app where money can be allocated for specific purposes, such as groceries, dining out, or savings goals.

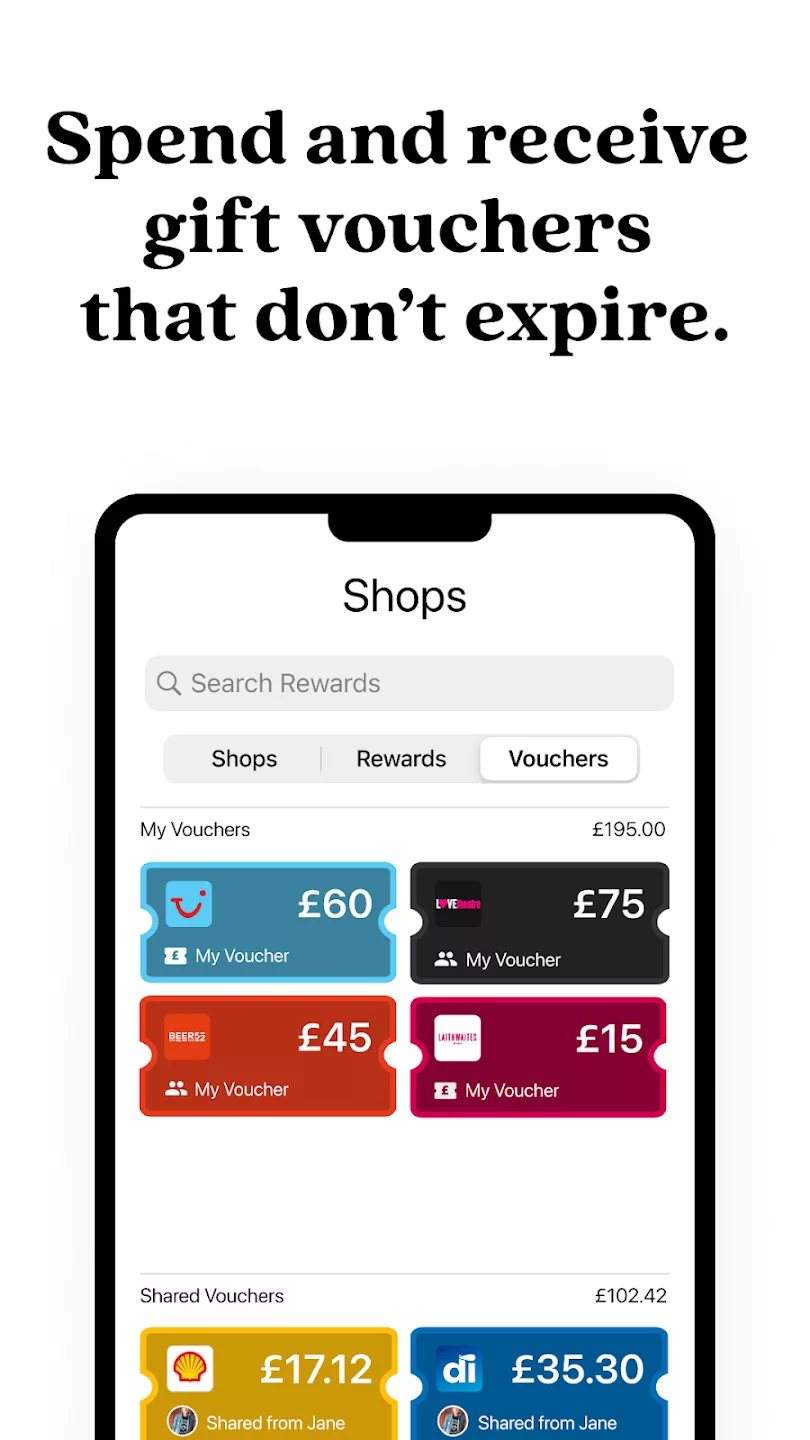

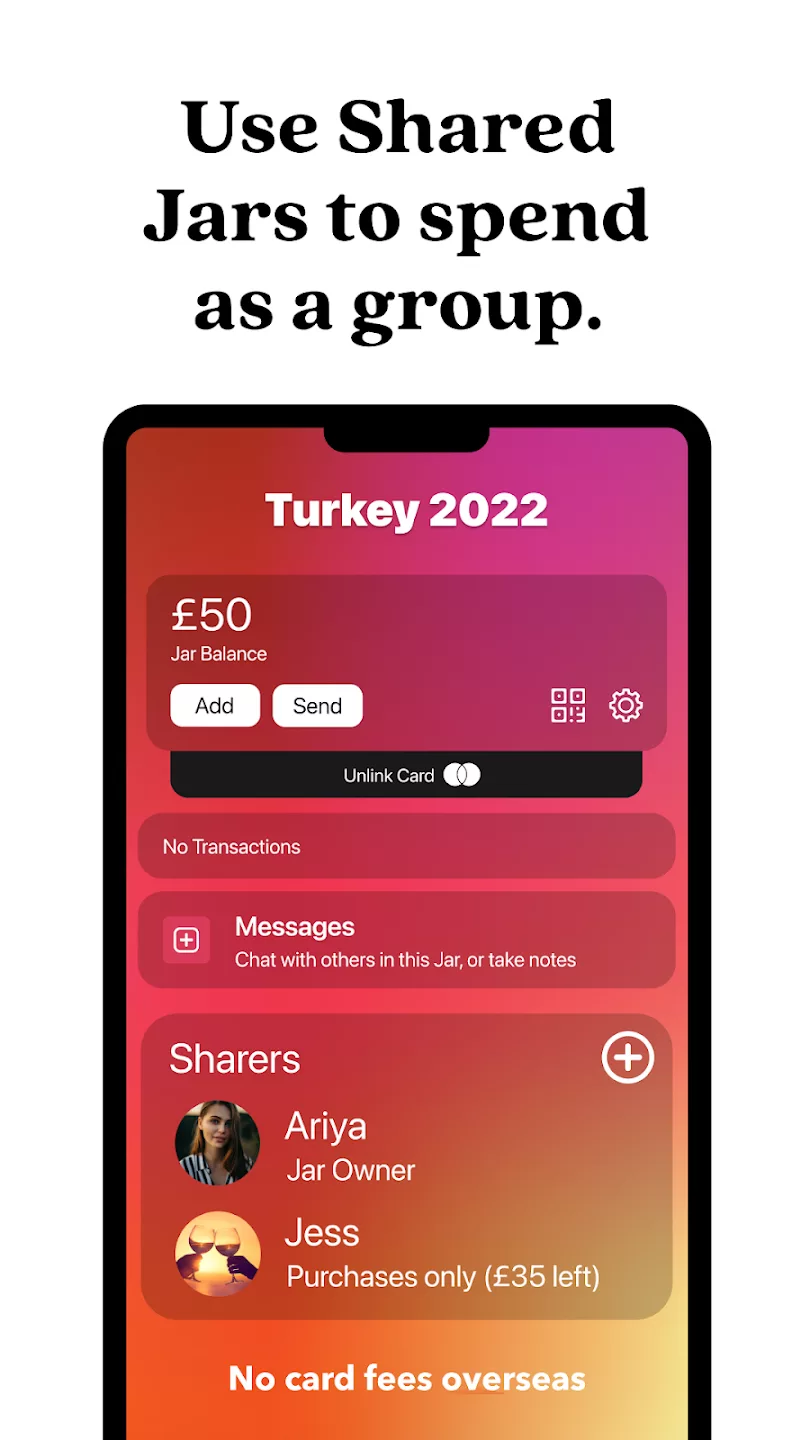

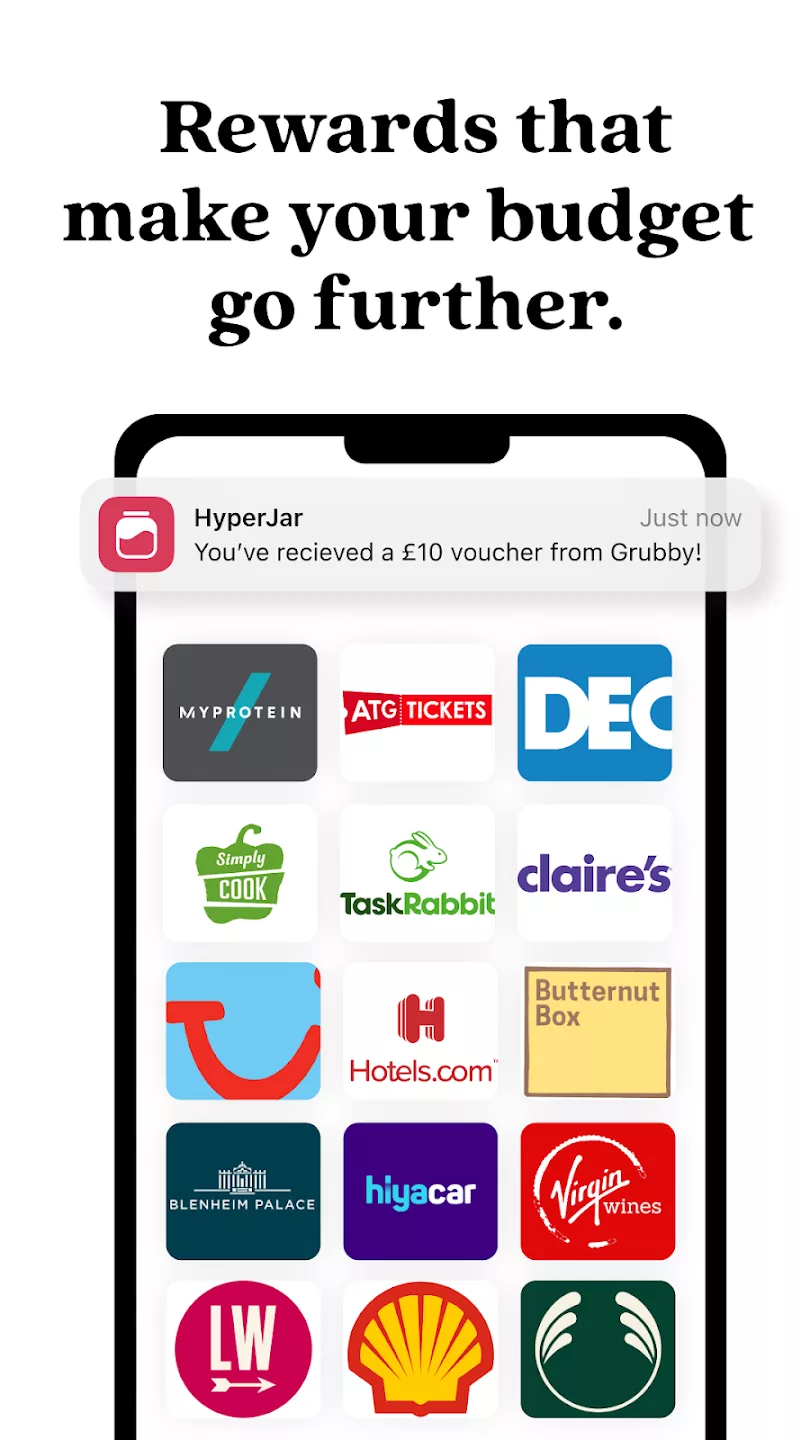

With a user-friendly interface, the app offers a seamless experience that blends budget management with real financial benefits. HyperJar enables users to collaborate with friends and family by sharing Jars, which is perfect for group goals or shared expenses. Additionally, the app often provides rewards and partnerships with various merchants, giving users discounts or enhanced cashback when they spend from a Jar linked to that merchant, stretching the value of every pound.

Security is a cornerstone of the HyperJar experience, guaranteeing users peace of mind with bank-level encryption and protection. Furthermore, the app often comes with a prepaid debit card linked to the user's Jars, allowing for a smooth transition from virtual budgeting to real-world spending. HyperJar's innovative approach to banking is tailored for the forward-thinking individual who values collaboration, customization, and control in their financial endeavors.

HyperJar is currently available for residents of the following countries:

United Kingdom

No, HyperJar is not a bank. It is a digital money management and budgeting app that offers prepaid cards to help users manage their finance

Yes, you can transfer money from your HyperJar account to your own linked bank account. This process requires an activated HyperJar card and can take up to 72 hours. However, it is not possible to make ATM withdrawals with your HyperJar card or send money to non-linked bank accounts. HyperJar focuses on digital money management and budgeting rather than traditional banking services.