TILLIT is a UK-based neobroker focused on simplifying the investment process by offering access to a curated selection of funds for long-term investors. TILLIT aims to streamline the often overwhelming and complex world of investing by reducing the number of investment options to only high-quality funds, selected by a team of experts. The platform's primary goal is to help individuals build diversified portfolios without the confusion and information overload that can come with traditional brokers offering thousands of investment choices.

The TILLIT platform is designed for investors who are looking for a hands-off, simplified approach to investing in funds, whether they are new to investing or experienced but looking for a more straightforward way to manage their portfolios. The platform offers a range of funds across different asset classes, including equity, fixed income, and alternative investments, enabling users to create diversified portfolios that align with their financial goals and risk tolerance. TILLIT’s curated approach means that only a small number of carefully selected funds are available, each having gone through a rigorous selection process by TILLIT’s investment team.

One of the standout features of TILLIT is its emphasis on quality over quantity. Unlike many other platforms that provide access to thousands of funds, TILLIT focuses on offering a smaller selection of funds that have been thoroughly researched and vetted. This curated approach helps to remove the complexity and confusion often associated with selecting investments, giving users confidence that the available options have already been reviewed for quality, performance, and alignment with different investment objectives.

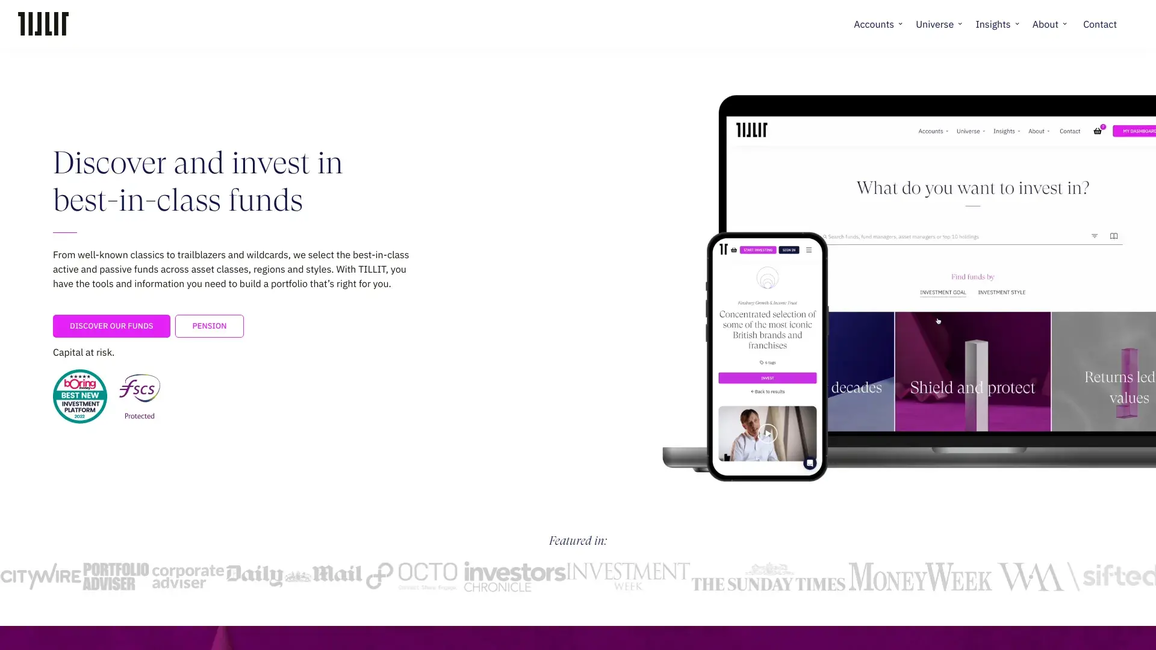

TILLIT also offers a user-friendly platform that prioritizes simplicity and transparency. The interface is designed to be easy to navigate, allowing investors to browse available funds, assess their performance, and invest without needing to navigate complex tools or jargon. Each fund listed on the platform comes with detailed information, including its investment strategy, past performance, fees, and risk level, providing investors with the necessary data to make informed decisions. TILLIT’s goal is to remove the guesswork from investing, making it easier for users to understand exactly what they are investing in and how it fits into their overall financial plan.

The platform’s fee structure is transparent and competitive, designed to keep costs low while ensuring that users get access to high-quality funds. TILLIT charges a flat platform fee based on the total value of a user’s investments, with no hidden costs or additional fees for buying, selling, or holding investments. This clear fee structure makes it easier for investors to manage their costs and understand exactly what they are paying for, ensuring that more of their money is working for them in the market.

TILLIT is regulated by the UK Financial Conduct Authority (FCA), providing investors with the reassurance that the platform adheres to stringent regulatory requirements for the protection of client assets. All client funds and investments are held in segregated accounts, ensuring that they are kept safe and separate from TILLIT’s own finances. Additionally, TILLIT is covered by the Financial Services Compensation Scheme (FSCS), which protects client assets up to £85,000 in the event of the company’s insolvency, offering an additional layer of security for investors.

In addition to its focus on offering a curated selection of high-quality funds, TILLIT also provides educational resources to help users understand the importance of long-term investing and how to build a well-diversified portfolio. The platform offers articles, guides, and tools that explain various investing concepts in simple terms, making it easier for users to make informed decisions about their financial future. TILLIT encourages a long-term, goal-oriented approach to investing, helping users stay focused on building wealth over time rather than chasing short-term market trends.

With its emphasis on simplicity, transparency, and quality, TILLIT is an appealing option for investors who want to take a more streamlined and focused approach to managing their investments. By offering a curated selection of funds and a user-friendly platform, TILLIT removes many of the barriers and complexities that can make investing intimidating, making it easier for individuals to build a portfolio that aligns with their goals and helps them achieve long-term financial success.