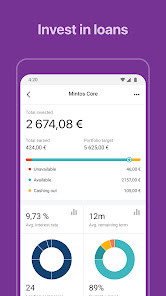

Mintos is a European investment platform that allows individuals to invest in loans issued by various lending companies across the globe. Established as a regulated financial institution under the European Union's MiFID (Markets in Financial Instruments Directive), Mintos provides a secure and transparent environment for investors. With over 500,000 registered users and more than €600 million in assets under administration, the platform has gained significant traction among both novice and experienced investors. Mintos offers a diverse range of investment options, including traditional loans, fractional bonds, and ETFs, enabling investors to create a well-rounded and diversified portfolio.

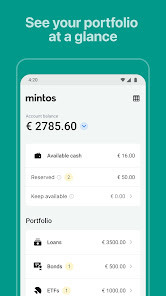

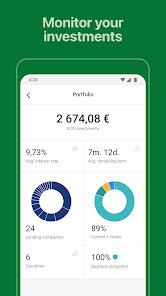

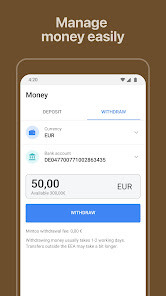

One of the key features of Mintos is its ease of use and accessibility. Investors can start with as little as €50 and choose from various investment strategies, such as automated investing through pre-configured portfolios or manual selection of individual loans. The platform's user-friendly interface and mobile app provide easy access to vital investment statistics and performance data, allowing investors to monitor their portfolios conveniently. Mintos also emphasizes investor protection, offering coverage up to €20,000 under the EU's investor compensation scheme, which protects investors if the platform fails to return financial instruments or cash.

Mintos stands out due to its strong regulatory framework and commitment to transparency. As an authorized investment firm, it ensures that investors' assets are held separately from Mintos’ own assets, providing an additional layer of security. The platform's innovative approach combines both traditional and alternative investments, giving users the opportunity to achieve attractive risk-adjusted returns. Mintos also supports an active secondary market, where investors can sell their investments to other users, providing liquidity options beyond the primary market. This combination of regulatory compliance, diverse investment opportunities, and investor protection makes Mintos a compelling choice for those looking to grow their wealth through long-term investments.