Kuda is a mobile-first challenger bank operating in Nigeria. It is branded as a 'microfinance bank' aiming to revolutionize the banking sector by leveraging technology to offer more accessible and affordable banking services. Kuda provides a fully digital experience, with no physical branches, enabling customers to conduct all banking activities such as account opening, transfers, bill payments, and access to loans through its mobile app.

The bank differentiates itself with a customer-centric approach, offering features like free transfers, no card maintenance fees, and competitive savings rates. Additionally, Kuda's platform integrates personal finance management tools to help users track their spending and manage their finances more effectively. The company's mission revolves around reducing the cost of banking for Nigerians and helping users save more.

Kuda benefits from the combination of mobile technology, an innovative business model, and a regulatory environment that supports the growth of fintech solutions. This progressive banking service is part of a growing movement in African financial technology that aims to increase financial inclusion and disrupt traditional banking on the continent.

Kuda is currently available for residents of the following countries:

Nigeria

24/7 availability- anytime, anywhere

No matter where you are, at home or abroad, you can access your Kuda account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

Get approved fast

Opening an account with Kuda is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Kuda doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

Lower fees

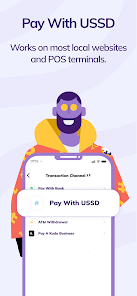

Another main reason to use Kuda is the low (or no!) fees. Kuda has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, Kuda offers zero fees on all transactions, including purchases made overseas!

Makes traveling easier

Kuda = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

Go paperless

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Kuda everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.