Wallester Business vs Payhawk: Which business payment solution is right for you?

Wallester Business and Payhawk are both corporate card and expense management platforms. However, there are some significant differences between the two.

Read moreWhen you have the Always Positive Account without commissions, you pay less for your insurance, electricity or telephone, you get the best financing, and you control the banks... You get used to having money!

Go to Fintonic Learn moreWe put every effort into ensuring information on Neolista is accurate. Double-check details that matter to you before opening an account.

Supported accounts:

PersonalA trusted, all-in-one rating that simplifies feedback from across the web.

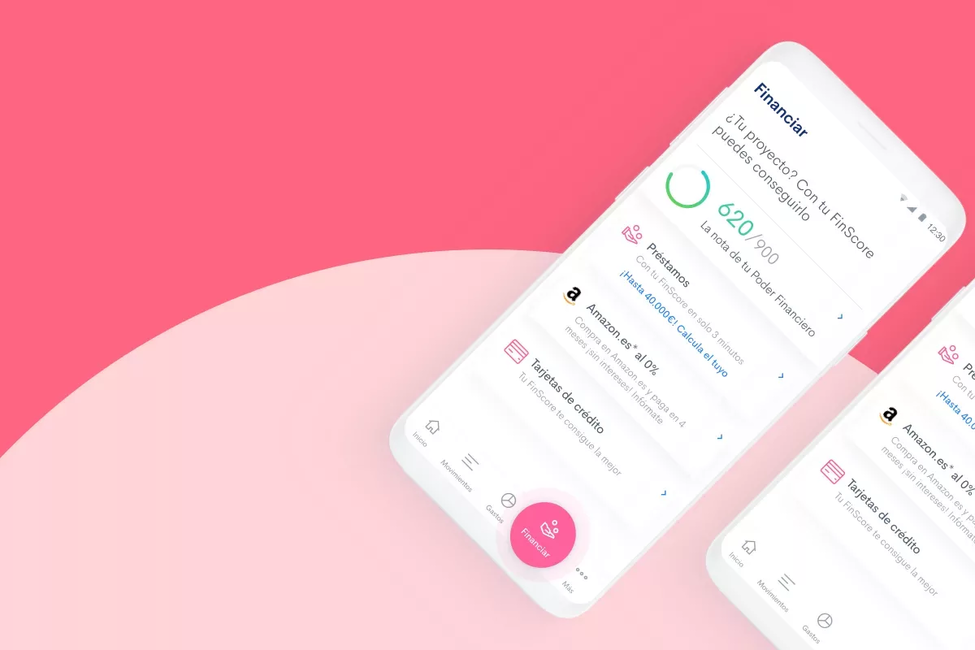

Fintonic is a mobile banking application designed to provide an intuitive and user-friendly platform for personal finance management. It allows users to aggregate their financial accounts in one place, giving them a comprehensive view of their income, expenses, savings, and investments. Fintonic categorizes transactions automatically to help users track and manage their spending habits more efficiently.

The app includes features such as budget setting, customized alerts for fees, due payments, and unusual transactions to help users stay on top of their finances. It also offers insights and personalized financial advice aimed at helping users make informed decisions about their money. Furthermore, Fintonic provides credit score services and tailored loan and insurance offers based on users' financial behavior, leveraging the power of data analytics to benefit consumers.

Fintonic prides itself on a high level of security, employing advanced encryption techniques to protect user data and ensure privacy. The app aims to be a one-stop solution for all personal finance needs, appealing to those who want to take control of their financial life in a convenient, modern, and proactive manner.

Go to FintonicExplore what real users have to say about their experiences with Fintonic. These 5-star reviews showcase the exceptional service and satisfaction provided by this neobank, giving you insight into why it's a top choice for customers worldwide.

Quiero expresar mi más sincero agradecimiento al equipo de Fintonic, y en especial a Miguel, por su excepcional ayuda en la gestión de mi préstamo personal. Desde el primer momento, Miguel se mostró muy profesional y atento, guiándome a través de todo el proceso con gran amabilidad y eficiencia. Gracias a su dedicación y experiencia, el trámite fue mucho más sencillo y rápido de lo que esperaba. Su capacidad para responder a todas mis preguntas y aclarar mis dudas me brindó una gran tranquilidad. Además, su compromiso por encontrar la mejor solución adaptada a mis necesidades financieras fue realmente notable. Es un verdadero placer contar con un equipo tan competente y comprometido como el de Fintonic. Recomiendo sus servicios a cualquier persona que busque una gestión financiera clara y confiable. ¡Excelente trabajo y apoyo!

08/08/2024

Fintonic es una herramienta excelente. Me ayuda a entender cómo se distribuye mi gasto y a controlar mis presupuestos, como cuánto dinero destino a la compra o a restaurantes. Además, ofrece recomendaciones muy personalizadas.

29/07/2024

Recientemente solicité un préstamo a través de la página web y fue muy fácil y rápido. Solo conecté mi cuenta y luego me contactaron por WhatsApp. Al final del día, tenía el préstamo aprobado y al día siguiente me consignaron el dinero. Además, las condiciones son mejores que las de mi propio banco.

29/07/2024

Esta aplicación ha sido muy útil para controlar diferentes aspectos de mis finanzas personales. Gracias al presupuesto que establecí, he podido gestionar mis cuentas y evitar sorpresas desagradables. Además, ofrece otros servicios útiles para encontrar las opciones más accesibles y asequibles para cada usuario.

23/07/2024

La app de Fintonic es una herramienta eficaz para el manejo de finanzas.

07/08/2024

Explore our comprehensive collection of blogs that delve into Fintonic and the world of mobile banking.

Wallester Business and Payhawk are both corporate card and expense management platforms. However, there are some significant differences between the two.

Read moreWallester Business, an all-in-one corporate card issuance and expense management platform, has launched a currency exchange capability that removes these banking charges altogether.

Read moreFor years, that cash sat in the same high-street banks grandma used: branch queues, paper token readers, invoices reconciled by hand on a Friday night. Spain, almost overnight, has become one of Europe’s most interesting laboratories for digital business money.

Read moreStill have a few things you'd like to clear up? We've put together the following simple answers to questions frequently thought, but rarely asked.

Fintonic is a mobile banking application designed to provide an intuitive and user-friendly platform for personal finance management. It allows users to aggregate their financial accounts in one place, giving them a comprehensive view of their income, expenses, savings, and investments. Fintonic categorizes transactions automatically to help users track and manage their spending habits more efficiently.

The app includes features such as budget setting, customized alerts for fees, due payments, and unusual transactions to help users stay on top of their finances. It also offers insights and personalized financial advice aimed at helping users make informed decisions about their money. Furthermore, Fintonic provides credit score services and tailored loan and insurance offers based on users' financial behavior, leveraging the power of data analytics to benefit consumers.

Fintonic prides itself on a high level of security, employing advanced encryption techniques to protect user data and ensure privacy. The app aims to be a one-stop solution for all personal finance needs, appealing to those who want to take control of their financial life in a convenient, modern, and proactive manner.

Fintonic is currently available for residents of the following countries:

SpainNo matter where you are, at home or abroad, you can access your Fintonic account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

Opening an account with Fintonic is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Fintonic doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

Another main reason to use Fintonic is the low (or no!) fees. Fintonic has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, Fintonic offers zero fees on all transactions, including purchases made overseas!

Fintonic = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Fintonic everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.

New 8 comparisons for Fintonic

New 8 comparisons for Fintonic