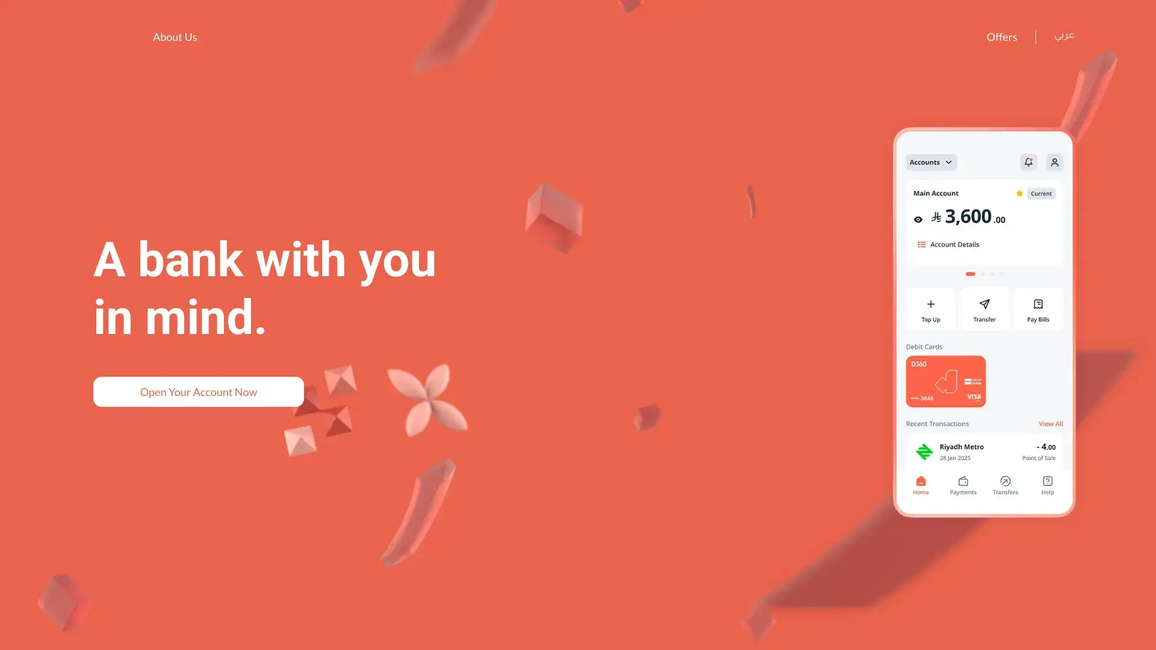

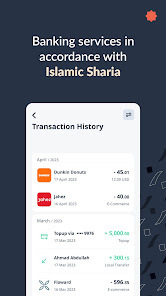

D360 is a progressive Neobank based in Saudi Arabia, designed to offer streamlined banking services through a fully digital platform. With a focus on innovation and user experience, D360 aims to redefine banking by providing customers with seamless, secure, and efficient financial management solutions.

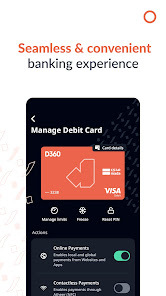

D360 provides a variety of services including savings accounts, payment solutions, and personal financial management tools, all accessible via their advanced mobile application. The bank leverages cutting-edge technology to ensure robust security measures and a user-friendly experience that caters to the modern consumer's lifestyle.

The neobank's platform also emphasizes financial inclusion, aiming to provide accessible banking solutions to a wider audience across Saudi Arabia. D360 is continually evolving, integrating new features and services to meet the dynamic needs of its customers, with a strong focus on transparency and customer support. By eliminating traditional banking friction points, D360 is dedicated to making banking simpler and more accessible for everyone.

D360 is currently available for residents of the following countries:

Saudi Arabia

24/7 availability- anytime, anywhere

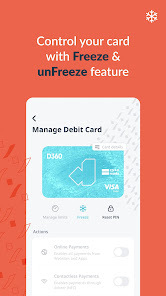

No matter where you are, at home or abroad, you can access your D360 account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

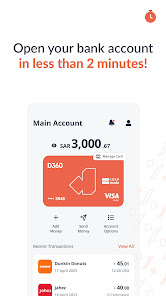

Get approved fast

Opening an account with D360 is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. D360 doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

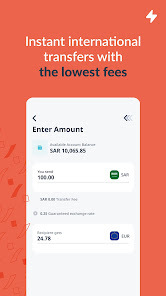

Lower fees

Another main reason to use D360 is the low (or no!) fees. D360 has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, D360 offers zero fees on all transactions, including purchases made overseas!

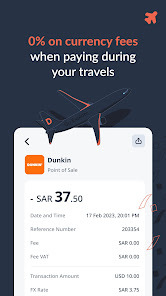

Makes traveling easier

D360 = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

Go paperless

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With D360 everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.