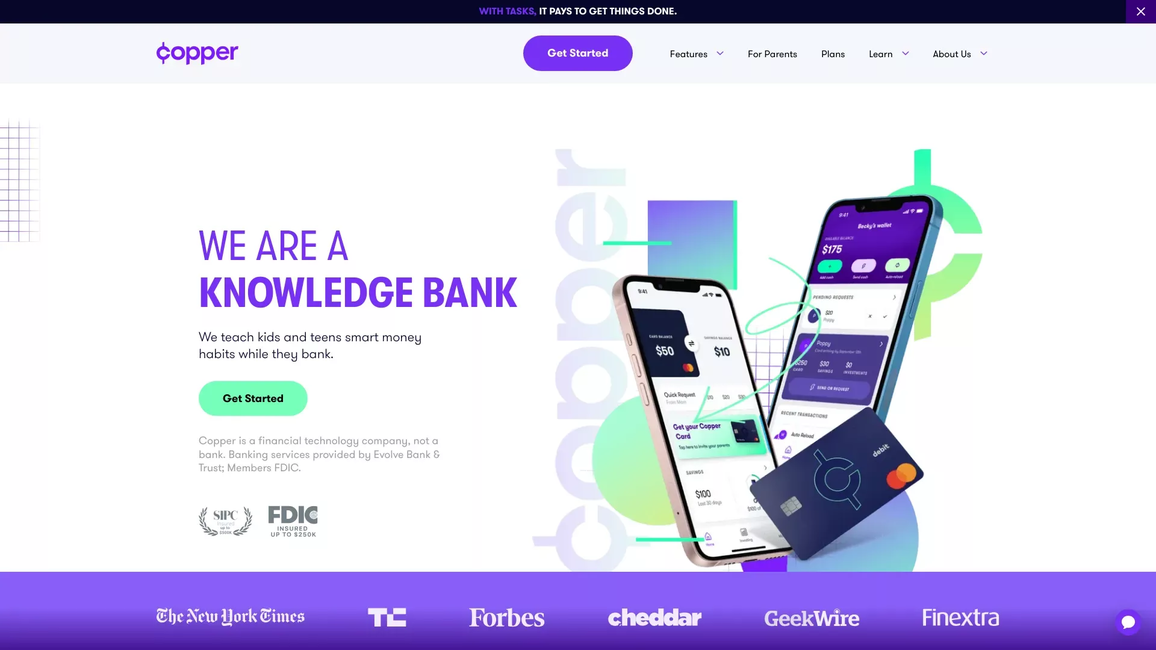

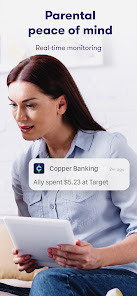

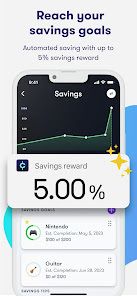

Copper is a mobile banking platform designed to cater to the banking needs of teenagers and young adults. It offers a modern approach to financial education by providing an app that allows parents and teens to manage money together. With features such as a debit card, automated savings tools, and real-time transaction notifications, Copper gives users the convenience of banking on the go while emphasizing financial literacy.

The platform typically includes a range of services like direct deposits, peer-to-peer transfers, and personalized saving goals to help users develop smart money habits. Copper often incorporates gamified learning experiences, where users can earn rewards for completing educational modules. The app is designed to be user-friendly, allowing for intuitive navigation and ensuring a seamless banking experience for the digital-savvy generation.

Copper is currently available for residents of the following countries:

United States

24/7 availability- anytime, anywhere

No matter where you are, at home or abroad, you can access your Copper account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

Get approved fast

Opening an account with Copper is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Copper doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

Lower fees

Another main reason to use Copper is the low (or no!) fees. Copper has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, Copper offers zero fees on all transactions, including purchases made overseas!

Makes traveling easier

Copper = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

Go paperless

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Copper everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.