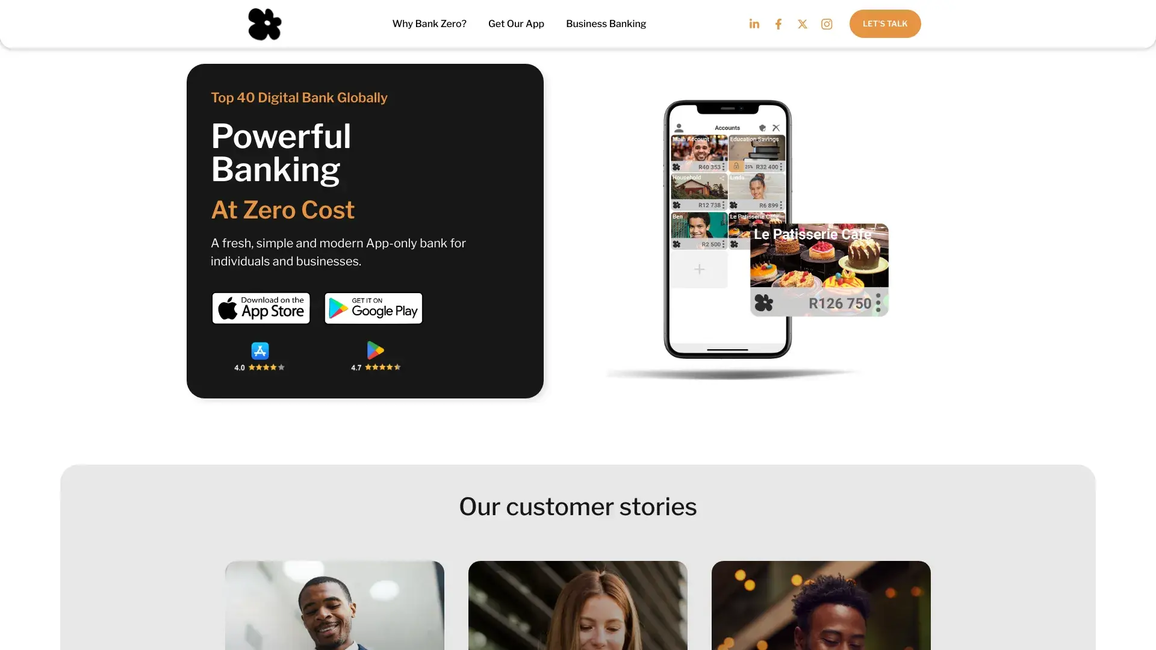

Bank Zero is a revolutionary neobank based in South Africa that offers a modern, digital-first approach to banking. It aims to transform financial management with its mobile app, providing users with streamlined, cost-effective solutions through its innovative banking model.

Established with a focus on empowering customers, Bank Zero provides a full-service banking experience directly from a smartphone, minimizing the need for physical branches. This approach allows the bank to keep its operational costs low, passing savings on to customers in the form of zero-fee structures for transactions. Bank Zero also offers highly competitive interest rates on deposits, enhancing the value for customers' savings.

The app-based platform provides users with complete control over their banking activities. Features include instant payments, comprehensive transaction history access, secure real-time notifications, and effortless fund transfers, all intended to enhance the customer experience. Additionally, Bank Zero prioritizes security with advanced encryption methods and a robust authentication process.

Bank Zero is spearheaded by a team of experienced professionals with extensive knowledge in finance and technology sectors. The founders aim to disrupt the traditional banking landscape by leveraging cutting-edge technology and fostering customer-centric innovation within the banking sphere.

As an agile and forward-thinking financial institution, Bank Zero continues to evolve, setting a benchmark for digital banking in South Africa with its commitment to transparency, simplicity, and customer empowerment.

Bank Zero is currently available for residents of the following countries:

South Africa

24/7 availability- anytime, anywhere

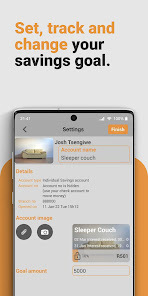

No matter where you are, at home or abroad, you can access your Bank Zero account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

Get approved fast

Opening an account with Bank Zero is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Bank Zero doesn’t require a copy of your credit history to approve your account, meaning you can open an account and get approved in minutes.

Lower fees

Another main reason to use Bank Zero is the low (or no!) fees. Bank Zero has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad. For example, Bank Zero offers zero fees on all transactions, including purchases made overseas!

Makes traveling easier

Bank Zero = borderless banking. Low/no exchange rates and low/no ATM withdrawal fees worldwide make traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. And for added safety, freeze or unfreeze your debit card while you travel, directly in the app.

Go paperless

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Bank Zero everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.