InvestEngine est une néobourse et une plateforme d'investissement basée au Royaume-Uni qui propose une approche simple, automatisée et à faible coût pour investir dans un portefeuille diversifié d'ETFs (fonds négociés en bourse). Elle vise à rendre l'investissement accessible à tous en offrant à la fois des options de portefeuille gérées et auto-gérées, permettant aux investisseurs de choisir une stratégie qui correspond le mieux à leurs objectifs et à leur tolérance au risque. La plateforme est conçue pour être facile à utiliser, en se concentrant sur l'investissement passif à long terme pour les individus qui souhaitent faire croître leur patrimoine au fil du temps.

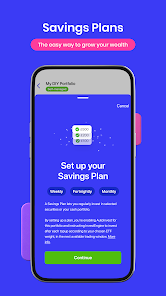

Une des fonctionnalités principales d'InvestEngine est sa gestion de portefeuille automatisée. Pour les utilisateurs qui préfèrent une approche sans intervention, la plateforme propose un service géré où elle construit et gère automatiquement un portefeuille d'ETFs en fonction des objectifs d'investissement de l'utilisateur, de son appétit au risque et de sa situation financière. Ces portefeuilles sont diversifiés sur plusieurs classes d'actifs, y compris les actions, les obligations et les matières premières, et sont rééquilibrés périodiquement pour maintenir l'allocation désirée.

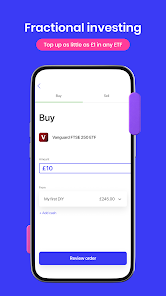

En plus des portefeuilles gérés, InvestEngine propose également une option d'investissement DIY (faites-le vous-même). Cette fonctionnalité s'adresse aux investisseurs plus expérimentés qui préfèrent construire et gérer leurs propres portefeuilles d'ETFs. Les utilisateurs peuvent choisir parmi un large éventail d'ETFs répertoriés sur la plateforme, couvrant divers secteurs, régions et types d'actifs. Cela permet une plus grande flexibilité et personnalisation, donnant aux investisseurs la liberté d'adapter leurs investissements selon leurs stratégies et préférences spécifiques.

InvestEngine se distingue en ne facturant aucun frais de plateforme ou de gestion pour ses portefeuilles DIY. Pour les portefeuilles gérés, la plateforme propose une structure tarifaire compétitive, avec un faible frais de gestion annuel qui couvre tous les services de gestion de portefeuille, y compris l'allocation d'actifs, le rééquilibrage et la surveillance continue. De plus, il n'y a pas de frais de transaction ou de retrait, ce qui en fait une option attrayante pour les investisseurs soucieux des coûts qui souhaitent maximiser leurs rendements sans être alourdis par des frais élevés. Comme pour tous les fournisseurs d'investissement, des frais d'ETFs s'appliquent.

La plateforme est régulée par l'Autorité de conduite financière du Royaume-Uni (FCA), garantissant qu'elle fonctionne dans le respect de normes réglementaires strictes et protège les investissements des clients. Les fonds et investissements des clients sont conservés en toute sécurité dans des comptes séparés, distincts des finances d'InvestEngine, ajoutant une couche supplémentaire de protection pour les investisseurs. De plus, la plateforme est couverte par le Schéma d'indemnisation des services financiers (FSCS), qui protège les liquidités et les actifs des clients jusqu'à 85 000 £ en cas d'insolvabilité de la société.

InvestEngine met également un fort accent sur la transparence et l'éducation. La plateforme fournit des informations détaillées sur chaque ETF qu'elle propose, y compris des données de performance, des actifs sous-jacents et des profils de risque. De plus, elle offre des ressources éducatives telles que des articles de blog, des guides et des vidéos pour aider les investisseurs à mieux comprendre les concepts d'investissement, les stratégies de portefeuille et les tendances du marché. Cet engagement envers l'éducation des investisseurs s'aligne sur la mission de la plateforme d'habiliter les gens à prendre le contrôle de leur avenir financier.

Avec sa combinaison d'options d'investissement gérées et DIY, de frais réduits et d'une plateforme intuitive, InvestEngine s'adresse à un large éventail d'investisseurs. Que quelqu'un soit novice en matière d'investissement et recherche une expérience simple et guidée ou un investisseur expérimenté cherchant à constituer son propre portefeuille d'ETFs, InvestEngine fournit une solution flexible et abordable pour construire une richesse à long terme.