InvestEngine is een in het VK gevestigde neobroker en investeringsplatform dat een goedkope, eenvoudige en geautomatiseerde aanpak van investeren in een gediversifieerde portefeuille van ETF's (Exchange-Traded Funds) biedt. Het doel is om beleggen toegankelijk te maken voor iedereen door zowel beheerde als zelf beheerde portefeuilles aan te bieden, waardoor investeerders een strategie kunnen kiezen die het beste past bij hun doelen en risicotolerantie. Het platform is ontworpen om gebruiksvriendelijk te zijn en richt zich op langetermijn, passief investeren voor individuen die hun vermogen in de loop van de tijd willen laten groeien.

Een van de kernfunctionaliteiten van InvestEngine is het geautomatiseerde portfoliomanagement. Voor gebruikers die de voorkeur geven aan een hands-off benadering, biedt het platform een beheerde service waarbij het automatisch een portefeuille van ETF's opbouwt en beheert op basis van de beleggingsdoelstellingen, risicobereidheid en financiële situatie van de gebruiker. Deze portefeuilles zijn gediversifieerd over meerdere activaklassen, waaronder aandelen, obligaties en grondstoffen, en worden regelmatig opnieuw gebalanceerd om de gewenste verdeling te behouden.

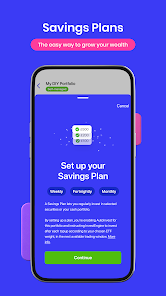

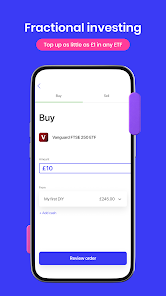

Naast de beheerde portefeuilles biedt InvestEngine ook een DIY (do-it-yourself) investeringsoptie. Deze functie is gericht op meer ervaren investeerders die de voorkeur geven aan het opbouwen en beheren van hun eigen ETF-portefeuilles. Gebruikers kunnen kiezen uit een breed scala aan ETF's die op het platform zijn genoteerd, dekken verschillende sectoren, regio's en activasoorten. Dit biedt meer flexibiliteit en personalisatie, waardoor investeerders de vrijheid hebben om hun investeringen af te stemmen op hun specifieke strategieën en voorkeuren.

InvestEngine onderscheidt zich door geen platform- of beheerskosten te rekenen voor zijn DIY-portefeuilles. Voor beheerde portefeuilles biedt het platform een concurrerende kostenstructuur, met een lage jaarlijkse beheersvergoeding die alle portfoliomanagementdiensten dekt, waaronder activaspreiding, herbalancering en voortdurende monitoring. Bovendien zijn er geen handels- of opnametarieven, wat het een aantrekkelijke optie maakt voor kostenbewuste investeerders die hun rendement willen maximaliseren zonder te worden belast door hoge kosten. Zoals bij alle investeringsaanbieders, zijn er wel kosten verbonden aan ETF's.

Het platform is gereguleerd door de Financial Conduct Authority (FCA) in het VK, wat ervoor zorgt dat het opereert onder strikte regelgeving en de investeringen van klanten beschermt. Klantfondsen en -investeringen worden veilig gehouden in afzonderlijke rekeningen, gescheiden van de eigen financiën van InvestEngine, wat een extra beschermingslaag voor investeerders toevoegt. Bovendien wordt het platform gedekt door het Financial Services Compensation Scheme (FSCS), dat de contante middelen en activa van klanten tot £85.000 beschermt in geval van insolventie van het bedrijf.

InvestEngine legt ook sterk de nadruk op transparantie en educatie. Het platform biedt gedetailleerde informatie over elke ETF die het aanbiedt, inclusief prestatiedata, onderliggende activa en risicoprofielen. Daarnaast biedt het educatieve middelen zoals blogposts, gidsen en video's om investeerders te helpen het begrip van beleggingsconcepten, portfoliostrategieën en markttrends te verbeteren. Deze focus op onderwijs voor investeerders sluit aan bij de missie van het platform om mensen in staat te stellen de controle over hun financiële toekomst te nemen.

Met de combinatie van beheerde en DIY-investeringsopties, lage kosten en een intuïtief platform spreekt InvestEngine een breed scala aan investeerders aan. Of iemand nu nieuw is in beleggen en op zoek is naar een eenvoudige, begeleide ervaring, of een ervaren investeerder die zijn eigen ETF-portefeuille wil opbouwen, InvestEngine biedt een flexibele en betaalbare oplossing voor het opbouwen van langdurig vermogen.