Wise and Cleo are two distinct mobile banking options that offer unique features and services to their customers.

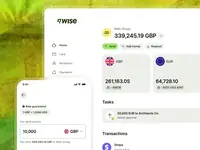

Wise, formerly known as TransferWise, is an international money transfer service that has expanded its offerings to include a multi-currency account and debit card. Wise allows users to hold and manage multiple currencies, make international transfers at competitive exchange rates, and spend abroad with low fees. They pride themselves on transparency and provide real-time exchange rate information.

Cleo, on the other hand, is an AI-powered financial assistant that helps users manage their finances. It connects to users' existing bank accounts and provides insights on spending habits, tracks expenses, and offers budgeting tools. Cleo uses AI algorithms to analyze transactions and provide personalized recommendations for saving money and managing finances more efficiently.

While Wise focuses primarily on international money transfers and currency exchange, Cleo is designed to provide financial insights and help users make better financial decisions. Wise offers a range of financial services and specializes in cross-border transactions, while Cleo aims to provide a holistic view of users' finances and assist with day-to-day money management.

The choice between Wise and Cleo depends on individual needs and priorities. If you frequently make international transfers or need multi-currency functionality, Wise would be a good option. On the other hand, if you value financial insights and personalized budgeting assistance, Cleo may be more suitable.