Wise (formerly TransferWise) and Tide are two distinct mobile banking platforms offering unique services targeted at different user bases.

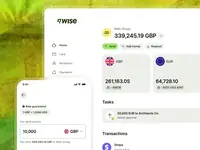

Wise, having started as a currency exchange platform, is known for its inexpensive and transparent money transfers across borders. It caters more to international travelers, expatriates, and businesses with international operations, offering multi-currency accounts in more than 50 currencies. Wise’s multi-currency debit card allows customers to spend abroad at real exchange rates, thus eliminating traditional banking fees. The platform has a clear pricing policy, charging a percentage-based fee profitably lower than traditional banks. For businesses, Wise offers practical features like batch payments and integration with accounting software. Despite these benefits, Wise suffers from a lack of direct bank deposit service, ATM withdrawal limits, and somewhat extended transfer times.

On the other hand, Tide, a UK-based mobile-only banking service, primarily targets small businesses, startups, and freelancers. This focus is evident in its features, which includes quick account setup, invoicing capabilities, automated bookkeeping and categorization of transactions for simpler tax returns. Tide enables its users to open multiple accounts for different purposes, helping business owners manage their finances better. Unlike Wise, Tide offers immediate setup of direct debits, faster payments, and BACS. However, they currently operate only within the UK and lack the international approach of Wise.

In conclusion, while both Wise and Tide are innovative mobile banking platforms, they serve different purposes and markets. Wise is best for those needing to easily move and manage money internationally at cheaper rates, while Tide is designed to help UK-based small businesses manage their finances more efficiently. As both platforms continue to grow, it's clear they are providing real alternatives to traditional banking models.