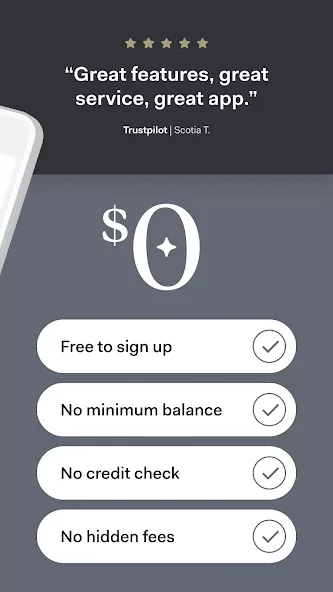

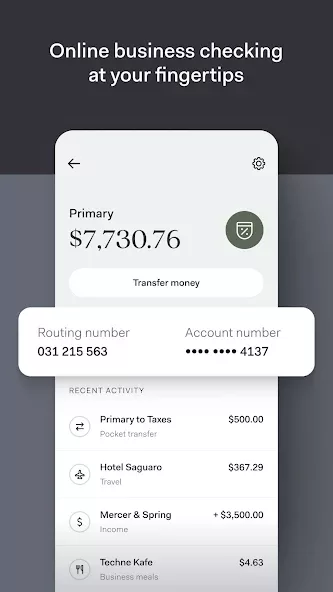

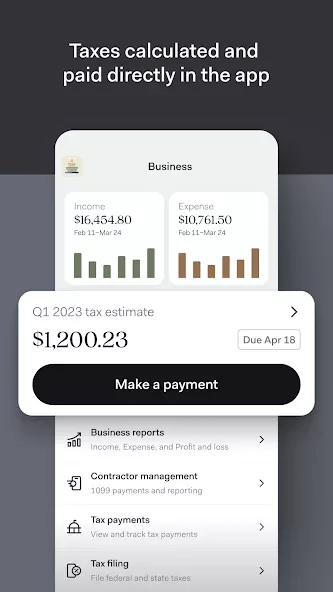

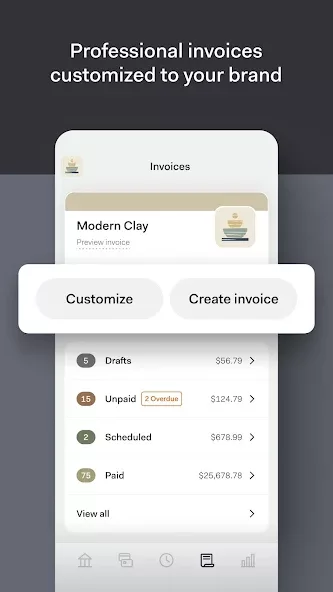

Found ist eine mobile und Desktop-App, die es Freiberuflern und Selbstständigen ermöglicht, ihr Geschäftsbanking durchzuführen, ihre Buchführung im Blick zu behalten und ihre Ausgaben über eine einzige Plattform zu verwalten. Found stellt den Nutzern eine Mastercard-Debitkarte für Geschäftsausgaben zur Verfügung, und das Unternehmen bietet Steuer- und Rechnungswerkzeuge, wie die automatische Rechnungserstellung und die Möglichkeit, Steuern über die App zu bezahlen.

Found hat keine monatliche Gebühr, es sei denn, Sie entscheiden sich für ein Upgrade auf Found+, ein neu eingeführtes, kostenpflichtiges Abonnementkonto mit weiteren Vorteilen. Zu diesen Vorteilen gehören die Möglichkeit, Ausgaben automatisch aus Belegen zu importieren, 1,5% APY auf Guthaben bis zu 250.000 $ zu verdienen und andere Premium-Steuer- und Buchhaltungsfunktionen.

24/7 availability- anytime, anywhere

No matter where you are, at home or abroad, you can access your Found account via the app, check your account balance, control your savings, get customer support, make payments and even freeze your debit card if needed. In addition, get real-time notifications every time you make a transaction, so there won’t be any surprises at the end of the month. No need to make appointments, stand in line and lose working hours to manage your finances.

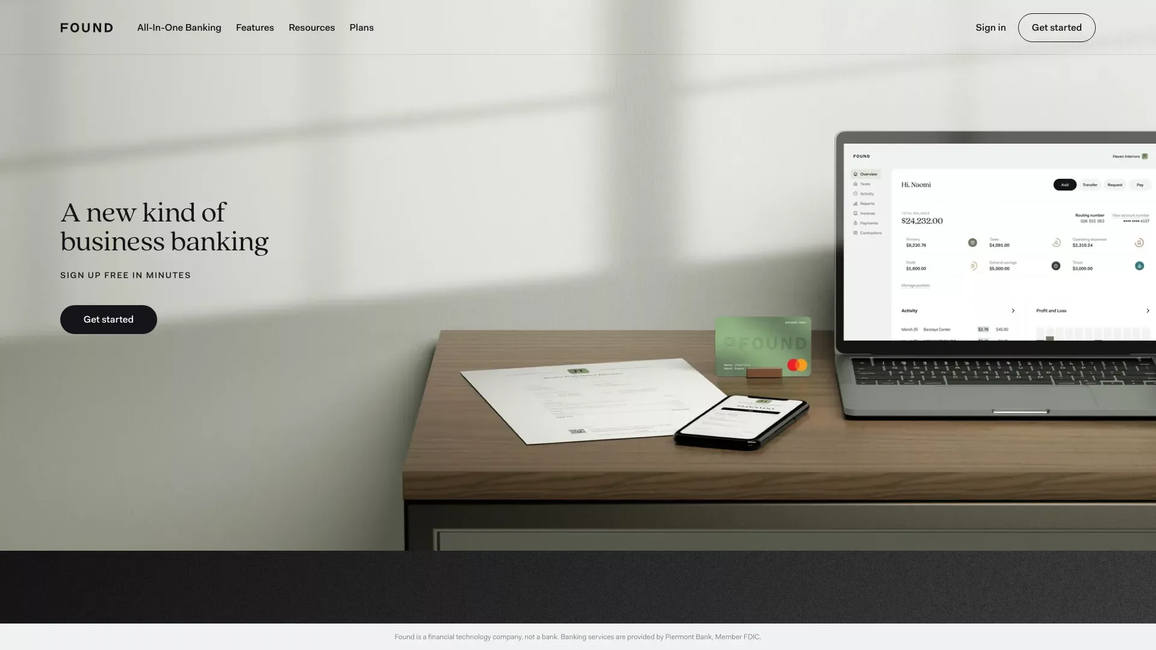

Get approved fast

Opening an account with Found is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go. Found doesn’t require a copy of your credit history to approve your account, meaning you can sign up in minutes.

Lower fees

Another main reason to use Found is the low fees. Found has no physical branches, therefore they can offer lower fees than traditional banks – especially when it comes to ATM withdrawals, money exchange/transfer and payments abroad.

Go paperless

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With Found everything you need is in the app and all communications are sent to your app or your email. Gone are the days of rummaging through piles of paper around your house – and protecting the environment is the cherry on top.

Found ist ein Finanztechnologieunternehmen, keine Bank. Bankdienstleistungen werden von der Lead Bank, Mitglied der FDIC, erbracht. Die Gelder auf Ihrem Konto sind bis zu 250.000 USD pro Einleger und pro Eigentumskategorie durch die FDIC versichert. Die Found Mastercard-Debitkarte wird von der Lead Bank gemäß einer Lizenz von Mastercard Inc. herausgegeben und kann überall dort verwendet werden, wo Mastercard-Debitkarten akzeptiert werden. Die Kernfunktionen von Found sind kostenlos. Found bietet außerdem ein optionales kostenpflichtiges Produkt, Found Plus, für 19,99 USD pro Monat oder 149,99 USD pro Jahr. Erweiterte optionale Buchhaltungssoftware ist mit einem Found Plus-Abonnement verfügbar. Es fallen keine monatlichen Kontoführungsgebühren an, jedoch Transaktionsgebühren für Überweisungen, Sofortüberweisungen und Geldautomatenabhebungen. Mehr Informationen hier: https://found.com/legal/fee-schedule-lead