Revolut and Suits Me are two online banking platforms that have gained significant popularity in recent years due to their innovations, ease of use and the flexibility they offer to customers.

Revolut, founded in 2015 in the United Kingdom, has established itself as one of the leading mobile banks globally. It allows customers to hold and exchange currencies at competitive rates with little to no fees. It further enables users to set up recurring payments, send money internationally, and purchase items with Revolut cards. One distinctive element about Revolut is that it provides access to cryptocurrency exchange, including Bitcoin, Ethereum, and more. Additionally, it offers a range of insurances, like mobile phone and overseas medical insurance. Although its accessibility includes wide international usage, certain services such as loans are only available in selected countries.

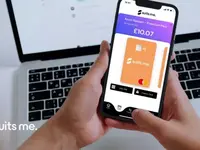

On the other hand, Suits Me, also headquartered in the U.K., launched in 2015 with a focus on providing banking solutions for those who might struggle to access traditional bank accounts. It offers a prepaid debit card, allowing users to manage funds, make purchases and withdraw cash like regular banks. It likewise provides the option to set up direct debits, payments and international transfers. Unique features in Suits Me include access to an 'Envelopes' feature for budgeting, cashback rewards at selected retailers, and no requirement for a minimum deposit. Suits Me provides banking solutions primarily to U.K. residents, making it less international than Revolut.

In conclusion, both Revolut and Suits Me offer innovative solutions that gear towards those seeking mobile banking. While Revolut provides a broader range of services, including cryptocurrency, and boasts wider international availability, Suits Me focuses on easy access banking services with the addition of reward schemes and budgeting aids, making it an appealing option for those living within the U.K.