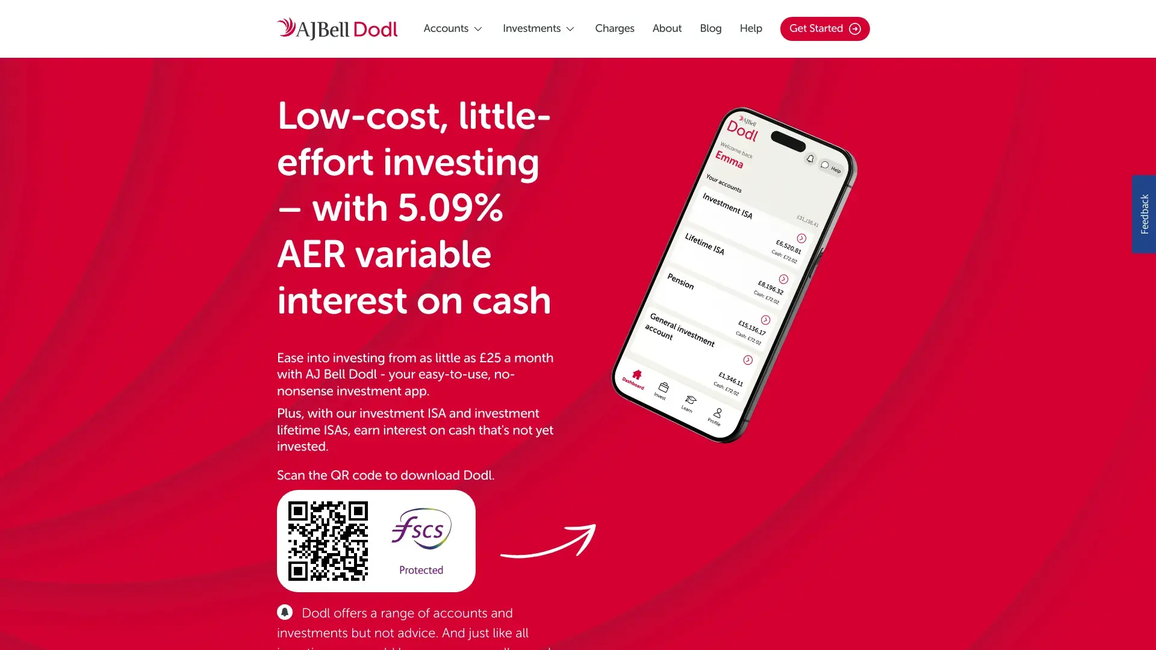

Dodl is a UK-based neobroker designed to make investing simple, affordable, and accessible for a wide range of users. Created by AJ Bell, one of the UK’s largest investment platforms, Dodl is aimed at people who may be new to investing or looking for a straightforward, no-frills approach to managing their money. By offering a user-friendly mobile app, low fees, and a limited but curated selection of investment options, Dodl focuses on helping individuals build and grow their wealth with ease.

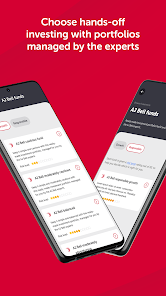

One of the key features of Dodl is its emphasis on simplicity. The platform is designed to remove the complexity often associated with investing, offering a streamlined interface that allows users to easily navigate through their investment options and make informed decisions. Dodl offers access to a range of ready-made portfolios and individual stocks, ETFs, and funds, providing users with the flexibility to either pick their own investments or rely on pre-built portfolios aligned with specific risk levels and goals. This makes it an ideal choice for beginners or those who prefer a hands-off approach to investing.

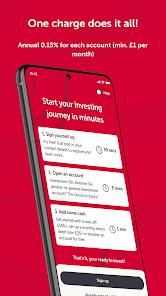

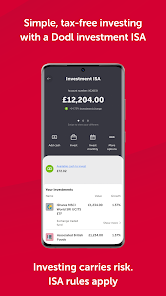

Dodl is also committed to keeping costs low for its users. The platform operates with a clear and simple fee structure, charging just a small annual platform fee based on the value of the investments. There are no additional fees for buying or selling investments, which helps keep overall costs manageable for users. This transparency in pricing is a key selling point for Dodl, allowing investors to grow their portfolios without worrying about hidden charges or complicated fee structures that are common with more traditional brokers.

One of Dodl’s unique offerings is its set of themed investment options, which allow users to invest in specific sectors or trends that match their interests or beliefs. These include themes like tech, healthcare, and sustainability, making it easy for users to align their investments with their values or areas they feel are poised for growth. This focus on themed investments caters to users who want to invest with purpose while keeping their portfolio diversified across different industries and asset classes.

The platform’s ready-made portfolios are designed by AJ Bell’s investment experts and are categorized by risk level, from cautious to adventurous. These portfolios offer a diversified mix of stocks, bonds, and other assets, helping users achieve a balance between risk and return that aligns with their personal preferences. By providing these ready-made options, Dodl makes it easy for users who are unsure about building a portfolio from scratch to get started with investing in a way that suits their comfort level.

Dodl also emphasizes accessibility through its mobile-first approach. The Dodl app is designed to make investing as easy as possible from a smartphone or tablet, allowing users to manage their portfolios on the go. With a focus on providing a seamless and intuitive experience, the app lets users quickly check their investments, make new purchases, or review their financial progress at any time. This level of convenience is especially attractive to users who prefer to manage their investments independently without the need for a desktop or in-person advisor.

Security is a top priority for Dodl, as the platform is backed by AJ Bell, a well-established and highly regulated financial services provider in the UK. Dodl is regulated by the Financial Conduct Authority (FCA), ensuring that it operates in accordance with strict financial regulations. Additionally, client assets are protected under the Financial Services Compensation Scheme (FSCS), which provides coverage of up to £85,000 per investor in the event of company insolvency. This gives users peace of mind knowing that their investments are held securely and in compliance with industry standards.

Dodl also offers educational resources and guides to help new investors understand key concepts about investing and financial planning. These resources are designed to demystify the investment process and provide users with the knowledge they need to make confident decisions. By focusing on education and simplicity, Dodl aims to empower users to take control of their financial futures, whether they are saving for retirement, a major purchase, or simply looking to grow their wealth over time.

With its low-cost structure, simple investment options, and a focus on accessibility, Dodl is an attractive choice for individuals who are new to investing or looking for a more straightforward way to manage their money. Backed by the expertise and security of AJ Bell, Dodl provides users with the tools and guidance they need to invest confidently and achieve their financial goals.