Chip is a UK-based neobroker and financial app designed to help individuals save and invest effortlessly. The platform combines savings automation with easy access to investment products, enabling users to grow their wealth without needing extensive financial knowledge or experience. Chip’s mission is to make saving and investing accessible to everyone by offering intuitive, user-friendly features that simplify both financial goals and the investment process.

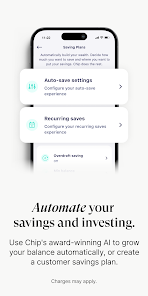

One of the key features of Chip is its automatic saving function. Using AI technology, the app analyzes users' spending habits and automatically sets aside small amounts of money on their behalf, without requiring manual intervention. This feature is customizable, allowing users to adjust the level of automatic savings based on their financial situation and preferences. The idea is to help people save consistently, even if they have not traditionally been good at putting money aside regularly.

In addition to its saving capabilities, Chip offers users a range of investment options. The platform provides access to diversified investment funds, including portfolios with varying levels of risk, allowing users to choose an investment strategy that aligns with their financial goals and risk tolerance. Chip simplifies the investment process by offering pre-built portfolios, making it easier for individuals who may be new to investing or unsure where to begin. The platform aims to provide straightforward, long-term investment options for users looking to grow their wealth over time.

Chip offers a flexible fee structure that appeals to different types of savers and investors. The app offers a free tier for its basic savings features, while users who want to access investment products or advanced features can opt for a paid subscription. This fee structure is designed to keep costs low, particularly for those who are just starting to save or invest, while still offering value for those who want additional services and features. Chip is transparent about its fees, ensuring users are fully aware of the costs involved in using its investment services.

The platform is regulated by the UK Financial Conduct Authority (FCA), ensuring that users’ money and investments are held in accordance with strict financial regulations. User funds are kept in segregated accounts, and investments are protected under the Financial Services Compensation Scheme (FSCS), offering users additional security and peace of mind. Chip’s compliance with regulatory standards reflects its commitment to safeguarding client assets and maintaining trust with its user base.

Chip is focused on creating a simple, stress-free experience for its users. The app’s interface is designed to be intuitive and easy to navigate, ensuring that users can quickly set up savings and start investing without any hassle. The platform also provides educational resources, including blogs, guides, and in-app insights, to help users better understand saving and investing. This focus on education helps users feel more confident in their financial decisions, whether they are saving for short-term goals or investing for the long term.

With its combination of automated saving, easy-to-access investment products, and a focus on simplicity, Chip appeals to a wide range of users, from those who are new to saving and investing to more experienced individuals looking for a hassle-free platform. By removing many of the traditional barriers to entry in the financial world, Chip aims to empower users to take control of their financial future and achieve their goals with ease.