Bestinvest is a UK-based neobroker and investment platform that offers a range of investment services, from financial advice and portfolio management to a DIY (do-it-yourself) option for self-directed investors. The platform is designed to cater to individuals who are seeking greater control over their investments while also providing professional guidance for those who need it. With a focus on transparency and customer support, Bestinvest aims to make investing more accessible and understandable for both novice and experienced investors alike.

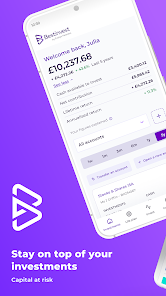

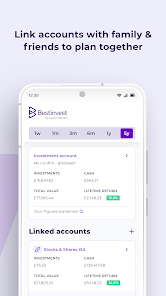

One of the standout features of Bestinvest is its hybrid approach to investment services. It allows users to choose between managing their own portfolios or receiving expert advice and ready-made portfolios. For those who prefer to take control of their investments, the platform offers a wide variety of asset options, including stocks, ETFs, mutual funds, and bonds. Investors can research, select, and manage their investments through an intuitive platform that provides access to a wealth of data and analysis tools to help them make informed decisions.

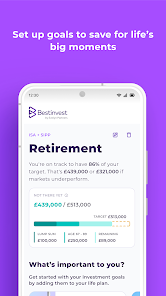

For investors who prefer a more guided approach, Bestinvest offers ready-made portfolios that are managed by its team of investment experts. These portfolios are designed to match various risk profiles and financial goals, ranging from conservative to more aggressive growth strategies. The platform’s experts actively manage these portfolios, adjusting asset allocation and rebalancing as needed to ensure that the portfolios remain aligned with the clients' investment objectives.

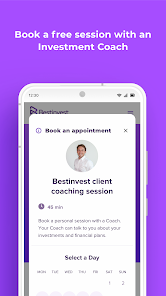

Bestinvest also distinguishes itself by offering free financial coaching as part of its service. Users can schedule one-on-one sessions with qualified financial coaches to receive personalized advice on a variety of topics, including retirement planning, investment strategy, and portfolio diversification. This feature is intended to help investors feel more confident about their financial decisions, regardless of whether they choose to manage their own portfolios or use the platform’s managed services.

In terms of fees, Bestinvest operates with a competitive pricing structure. For self-directed investors, there are no fees for buying or selling ETFs or mutual funds, and users benefit from low account management fees. For those using the managed portfolio option, there is an annual fee that covers all aspects of portfolio management, including ongoing monitoring, asset allocation, and regular rebalancing. Bestinvest is committed to keeping its fees transparent, and there are no hidden charges or additional costs for services like financial coaching.

As a regulated entity under the UK Financial Conduct Authority (FCA), Bestinvest ensures that all client investments are handled in accordance with strict regulatory standards. Client assets are held separately from the company’s own funds, offering a layer of protection in the event of financial difficulties. Furthermore, the platform is protected by the Financial Services Compensation Scheme (FSCS), meaning clients' assets are insured up to £85,000 in case of insolvency.

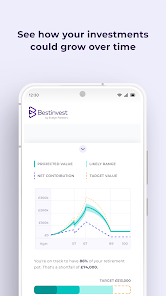

Bestinvest provides a comprehensive suite of research and analytical tools to help investors make well-informed decisions. This includes detailed information on individual assets, performance reports, risk assessments, and market analysis. Additionally, the platform has a strong focus on investor education, offering resources such as webinars, investment guides, and articles that cover a wide range of financial topics. These educational materials are designed to empower users to improve their financial literacy and take a more active role in their wealth management.

With its mix of self-directed investment options, professional financial advice, and robust educational resources, Bestinvest caters to a broad spectrum of investors. Whether an individual prefers to manage their own investments or take advantage of expert management, Bestinvest provides a flexible and supportive environment designed to help clients achieve their financial goals.